Austrian insurance market

At around 60%, the share of total premiums generated by property and casualty insurance together with health insurance is relatively high in Austria compared to other Western European insurance markets. Insurance density is still relatively low for life insurance, however, which offers definite potential.

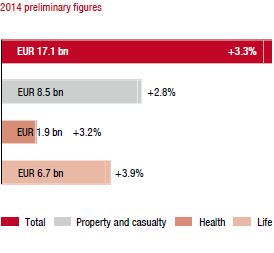

Preliminary estimates of premium volume for the Austrian insurance market are EUR 17.1 billion in 2014. This would be a year-on-year increase of 3.3%. Life insurance recorded growth of 3.9% in the same period. The increase was due to excellent performance by single-premium products, which was favourably influenced by a reduction of the tax-related minimum lock-in period from 15 to ten years for people 50 years of age and older. The rule has been in effect since 1 March 2014 and generated particularly strong interest for single-premium products in the over 60 age group. Traditional pension insurance also recorded strong growth. This was due to a focus on the new pension account and the potential that still exists in the area of pensions. The trend to lower interest rates will continue in 2015. The guaranteed interest rate (the maximum that may be guaranteed to policy holders) was therefore reduced from 1.75% to 1.50% for new life insurance policies at the beginning of 2015.

Property and casualty insurance recorded growth of 2.8% in 2014. Motor vehicle own-damage insurance recorded particularly good growth of 4.7% due to the increase in average premiums. In addition to property and casualty insurance and life insurance, premium income also rose for health insurance. Growth was 3.2% in 2014 compared to the previous year.

Insurance density was EUR 1,954 in Austria in 2013, of which EUR 1,190 was for non-life insurance and EUR 764 for life insurance.

Market growth in 2014

|

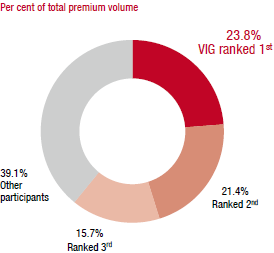

Market shares of the major insurance groups

|

VIG companies in Austria

VIG is represented in Austria by Wiener Städtische, Donau Versicherung and s Versicherung. VIG Holding is assigned to the Central Functions, but also operates out of Austria to provide international reinsurance and insurance in the cross-border corporate customer business. In addition, Wiener Städtische has branches in Italy and Slovenia, and Donau Versicherung also operates a branch in Italy.

Vienna Insurance Group’s total market share in 2014 was 23.8%, making it the leading insurance group in Austria. VIG is also number 1 in property and casualty insurance with a market share of 21.5%, and the market leader in life insurance with 27.7%. VIG holds second place in the area of health insurance.