Czech insurance market

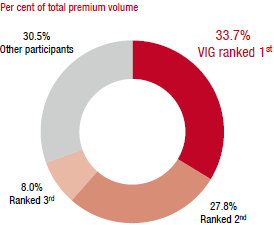

The Czech insurance market shows a high level of market concentration. Taken together, the top 5 insurance groups represent more than 80% of total premium volume.

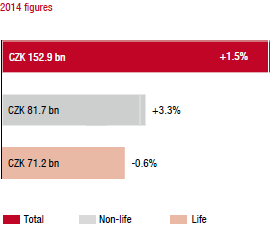

In local currency terms, premiums written in the Czech Republic rose by 1.5% year-on-year in 2014. This growth was due to good performance of non-life insurance, which recorded an increase of 3.3%. The largest contribution came from motor vehicle liability insurance (+4.6% year-on-year), where average premiums rose again after many years of decline. A new civil code was introduced in January 2014 that affects how claims payments are determined, among other things. In local currency terms, premium income in the life insurance segment was slightly lower by 0.6% year-on-year in 2014. Premium volume was marginally below the previous year for both regular-premium and single-premium products.

Average per capita expenditures for insurance premiums were EUR 548 in the Czech Republic in 2013, of which EUR 288 was for non-life insurance and EUR 260 for life insurance.

Market growth in 2014

|

Market shares of the major insurance groups

|

VIG companies in the Czech Republic

VIG is represented by three insurance companies in the Czech Republic: Kooperativa, ČPP and PČS. Although the Group reinsurance company, VIG Re, has been operating in Prague since 2008, it belongs to the Central Functions.

VIG has a market share of 33.7% in the Czech Republic. The Group holds first place for total premiums and in life insurance and second place in non-life insurance.