Premium volume and expenses

Premium volume

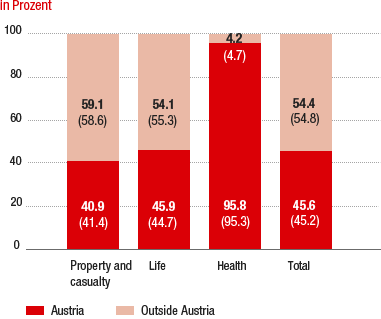

PREMIUM PERCENTAGE BY LINES OF BUSINESS AND REGION

(Figures for 2014 in parentheses)

A brief presentation of premium development is included under Note 28 “Net earned premiums” of the notes to the consolidated financial statements.

In 2015, Vienna Insurance Group generated stable premium volume of EUR 9,019.76 million despite the continuing low level of interest rate and its consistent earnings-oriented underwriting policy. In comparison with the previous year, this corresponds to a decrease of 1.4%. Adjusted for single premium products, the Group recorded a solid 2.2% increase in premiums. Vienna Insurance Group retained EUR 8,219.94 million of the gross premiums written. EUR 799.82 million was ceded to reinsurance companies (2014: EUR 808.55 million).

Total premium growth was particularly strong in the Remaining Markets, such as the CEE countries of the Baltic States (+15.0%), Bulgaria (+14.6%), Serbia (+14.1%), Turkey (+12.3%) and Hungary (+13.5%), which recorded double-digit growth rates.

Overall, the Group generated 54.4% of its premiums outside Austria in 2015. For property and casualty insurance, the share contributed by companies outside Austria was 59.1%. In the area of life insurance 54.1% of premiums were generated outside of Austria, and 4.2% of health insurance premiums were generated outside of Austria by the Georgian companies.

Net earned premiums fell by 2.1% from EUR 8,353.74 million in 2014 to EUR 8,180.54 million in 2015. Net reinsurance cessions were EUR 801.00 million (2014: EUR 804.63 million).

Expenses for claims and insurance benefits

A brief presentation of expenses for claims and insurance benefits is included under Note 32 “Expenses for claims and insurance benefits” of the notes to the consolidated financial statements.

Expenses for claims and insurance benefits less reinsurances’ share of EUR 358.70 million (2014: EUR 448.12 million) were reduced in 2015 by 2.5% to EUR 6,748.87 million. The decline can mainly be attributed to lower allocations to the actuarial reserve due to the decline in single premium business in the Czech Republic as a result of the low level of interest rate, as well as the targeted reduction in single premium products in life insurance in Poland.

Acquisition and administrative expenses

A brief presentation of acquisition and administrative expenses is included under Note 33 “Acquisition and administrative expenses” of the notes to the consolidated financial statements.

Acquisition and administrative expenses for all consolidated companies in the VIG Group were reduced in 2015 to EUR 1,847.57 million. This corresponds to a drop of 1.5% in comparison with the previous year.