Baltic states

The Baltic states consist of the countries of Estonia, Latvia and Lithuania.

The Baltic insurance market

In the insurance market in the Baltic states, many companies that have their registered office in one of the three Baltic states are also represented by branches in the other two markets. As a result, there is an above-average number of participants in the market. For example, more than 20 active companies or branches are operating in Lithuania. The top five insurance groups generated slightly more than 70% of total premium volume in the Baltic states in the 1st to 3rd quarters of 2016.

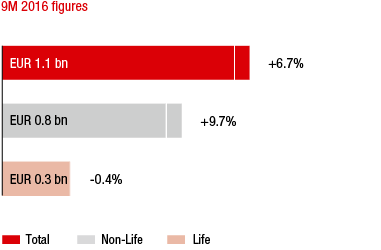

MARKET GROWTH IN THE 1ST TO 3RD QUARTERS OF 2016 COMPARED TO THE PREVIOUS YEAR

Source: The Estonian National Statistics Board, Latvian Insurers Association, Central Bank of the Republic of Lithuania

The positive growth trend recorded in the Baltics in recent years continued in the 1st to 3rd quarters of 2016. All three Baltic states displayed significant year-on-year increases in premiums. Estonia recorded an increase of 6.7%, Latvia 5.1% and premium volume rose 7.4% in Lithuania.

Non-life insurance recorded particularly large growth rates in the 1st to 3rd quarters of 2016. In Estonia, premiums rose 8.7% in the non-life area, in Latvia 5.4% and in Lithuania even as high as 12.6%.

Growth rates were mixed for life insurance in the three Baltic states, with premiums increasing 4.2% in Latvia and falling 2.6% in Lithuania. Life insurance premiums also recorded a slight decrease of 0.4% in Estonia in the 1st to 3rd quarters of 2016.

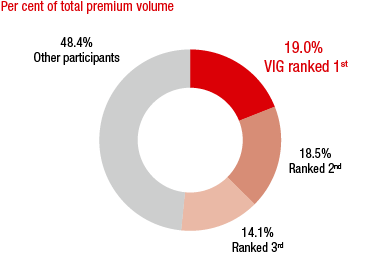

MARKET SHARES OF THE MAJOR INSURANCE GROUPS

Source: The Estonian National Statistics Board, Latvian Insurers Association,

Central Bank of the Republic of Lithuania; as of 9M 2016

The three Baltic states also differ amongst each other in terms of insurance density. While average per capita expenditure on insurance was EUR 373 in Estonia in 2015 – EUR 301 for non-life and EUR 72 for life insurance – the comparable value for Latvia was EUR 267. Latvians spent EUR 209 of this amount on non-life insurance and EUR 58 on life insurance. Lithuania had an insurance density of EUR 222 in 2015. Of this, EUR 141 was spent on non-life insurance and EUR 81 on life insurance.

VIG companies in the Baltic States

Vienna Insurance Group operates in Estonia through the Group company Compensa Life, which is also represented by branches in Latvia and Lithuania. In Latvia, in addition to BTA Baltic, VIG is also represented by the property and casualty insurer Baltikums, which also has branches in Lithuania and distributes its products via brokers in Estonia. Compensa Non-Life was established in Lithuania in 2015 and took over the business previously managed from Poland. It also maintains branches in Latvia and Estonia.

Following official approval of the BTA Baltic acquisition on 24 August 2016, Vienna Insurance Group became the leadng insurance group in the Baltic insurance market in the 1st to 3rd quarters of 2016. The Group holds second place in the non-life insurance market and third place in life insurance.

Business development in the Baltic States in 2016

Premium development

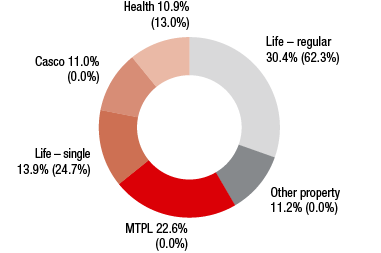

PREMIUMS WRITTEN BY LINE OF BUSINESS

Values for 2015 in parentheses

Premiums written in the Baltic states rose to EUR 140.19 million in 2016 (2015: EUR 59.31 million). The sharp year-on-year increase in premiums was primarily due to the newly founded insurance company Compensa Non-Life that was established in 2015 and to the property and casualty company Baltikums that was acquired in the previous year. Net earned premiums were EUR 108.10 million in 2016, 87.2% higher than the previous year.

Expenses for claims and insurance benefits

Expenses for claims and insurance benefits less reinsureance were EUR 85.16 million in 2016 (2015: EUR 48.76 million). The year-on-year increase of 74.7% was also primarily due to the newly founded insurance company Compensa Non-Life that was established in 2015 and to the property and casualty company Baltikums that was acquired in the previous year.

Acquisition and administrative expenses

VIG recorded EUR 35.16 million in acquisition and administrative expenses in the Baltic states in 2016 (2015: EUR 15.32 million). The main reason for this increase was the new insurance company established in 2015 and the property and casualty insurer Baltikums that was acquired in the previous year.

Result before taxes

The loss of EUR 11.23 million reported in 2016 was primarily due to start-up losses for Compensa Non-Life resulting from transfer of the Baltic non-life business from a Polish Group company (2015: EUR -2.65 million).

Combined ratio

The start-up losses of Compensa Non-Life following transfer of the Baltic non-life insurance business from a Polish Group company also had an effect on the combined ratio, which was 135.4% in 2016.

in EUR million |

2016 |

2015 |

2014 |

Premiums written |

140.19 |

59.31 |

51.56 |

Motor own damage insurance |

15.50 |

0.00 |

0.00 |

Motor third party liability insurance |

31.67 |

0.00 |

0.00 |

Other property and casualty insurance |

15.66 |

0.00 |

0.00 |

Life insurance – regular premium |

42.66 |

36.95 |

39.17 |

Life insurance – single-premium |

19.49 |

14.66 |

12.39 |

Health insurance |

15.22 |

7.69 |

0.00 |

Result before taxes |

-11.23 |

-2.65 |

-0.70 |