Highlights 2014

|

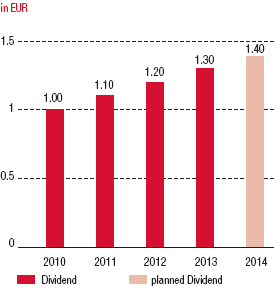

Group premiums EUR 9.1 billion Close to the same level as the previous year, in spite of negative factors (in particular, exchange rate effects, Poland, Italy), around 54.8% of all premiums generated outside Austria. No. 1 in the core markets VIG expands its market share in core markets to a total of 19%. Profit before taxes EUR 518.4 million Result improves significantly by 46.0% over previous year – all lines of business and regions provide positive contributions. Earnings per share rose even more strongly by 75.5% to EUR 2.75. Planned dividend per share EUR 1.40 VIG maintains dividend policy with an increase of EUR 0.10. Development of dividend per share |

96.7% net combined ratio Underwriting result improves in spite of numerous natural disasters. The programme and measures for improving efficiency and profitability will be systematically continued. Optimally prepared for Solvency II Due to effective Group-wide preparations, VIG is optimally prepared for this reform of capital requirements. A+ with a stable outlook Confirmed by Standard & Poor’s again. VIG has the best rating in the ATX Index. Entry into the Moldovan market VIG’s acquisition of the Moldovan insurer Donaris extends its operations to 25 countries. |