Investments, shareholders’ equity and underwriting provisions

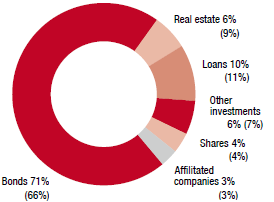

Breakdown of investments 2014

Investments

A brief presentation of the investments is included on page 107 of the notes to the consolidated financial statements.

Total Vienna Insurance Group investments (including cash and cash equivalents) were EUR 31,141.53 million as of 31 December 2014. Compared with the previous year, this represents an increase of EUR 1,327.96 million, or 4.5%. The significant upward movement recorded in bond markets was a major reason for this increase.

The investments include all Vienna Insurance Group land and buildings, all shares in at equity consolidated companies and all financial instruments, with fund overviews for consolidated institutional funds, as well as other fund investments allocated to the asset classes. Investments for unit-linked and index-linked life insurance are not included. These rose by 15.4% in 2014 from EUR 6,707.28 million to EUR 7,742.18 million due to a satisfying increase in unit-linked life insurance premiums.

Shareholders' equity

Vienna Insurance Group’s capital base increased by 6.4% to EUR 5,283.43 million in 2014 (2013: EUR 4,966.55 million). This was due to an increase in the result for the period and unrealised gains from financial instruments available for sale.

Underwriting provisions

Underwriting provisions (excluding underwriting provisions for unit-linked and index-linked life insurance) were EUR 27,889.95 million as of 31 December 2014, representing an increase of 7.3% over the previous year (2013: EUR 25,980.46 million). An increase in the actuarial reserve in the Austrian life insurance business was a major factor in this.