The challenge of low interest rates

VIG – conservative investment continues

0.05% interest rate. The European Central Bank (ECB) lowered its key interest rate to this historic low on 4 September 2014. A previous reduction in June had reduced the rate from 0.25% to 0.15%.

This decision was made because of increasing concerns about deflation in view of the low – and in some cases negative – inflation in Eurozone countries. In such an environment, companies and consumers could defer investments and purchases in expectation of further price reductions, thereby further endangering the already fragile economic situation in Europe. However, what effects does this interest rate level have on the insurance industry?

The main effects are felt by life insurance companies, which give customers a guaranteed interest rate. As a result of the current low level of interest rates, the Austrian Financial Market Authority felt impelled to reduce this guaranteed interest rate from the previous 1.75% to 1.5% for new life insurance policies starting in 2015.

How well have Austrian insurance companies managed with these interest rates so far? According to information from the Austrian Insurance Association the total return earned on Austrian life insurance policies in 2013, including profit participation, averaged 3.25%, and by itself the guaranteed interest rate for existing policies was 2.7% to 2.8%. This indicates that insurance companies were able to earn an adequate return on their investments in spite of the low level of interest rates.

Promises made – and kept

The challenge for life insurance companies is to make payments that were promised 20, 30 or even more years ago. The maturities of these obligations must be matched with the investments that cover them, and ensuring this is the main responsibility of asset-liability management. “If I guarantee a customer that 30 years in the future I will repay him the premiums he has contributed plus interest at a certain rate, and I simultaneously invest in a bond that guarantees at least this rate of interest, there is no problem”, states Werner Matula, head of the Actuarial Department of VIG Holding.

There are strict regulations on how premiums contributed to a traditional life insurance policy can be invested. In addition, the Austrian Financial Market Authority previously prescribed a supplementary interest reserve for 2013 to ensure that insurance companies can fulfil their payment obligations in local currency. This is also the goal of the regulatory and supervisory provisions collected under the Solvency II banner (read more).

Conservative investment

VIG has always followed a conservative investment strategy. Binding investment guidelines exist for each VIG company, and compliance is strictly monitored. Careful attention is also paid to earning a positive underwriting result in non-life business lines. Improvement of the combined ratio to 96.7% confirms VIG’s strategy in this respect. “We will continue to take great care to ensure that we can meet our future commitments to customers when designing future products”, said Matula, summarising the basic approach taken by VIG.

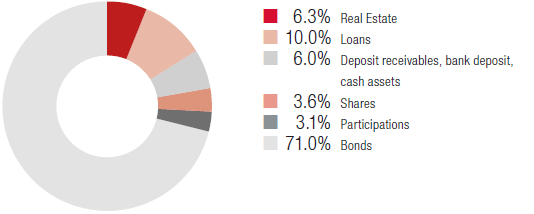

VIG investments

Diversification. VIG managed total investments of EUR 31.1 billion at the end of 2014. The following chart shows the structure of investments. This does not include investments for unit-linked and index-linked life insurance, which were EUR 7,742.2 million as of 31 December 2014.