Well positioned is half the battle.

VIG markets have potential for the future

Success 25 times over. Thanks to its internationalisation strategy, Vienna Insurance Group is a reliable partner for its customers in 25 countries.

When you take a trip, there is much to tell. Especially if you travel to all 25 countries where VIG operates. Europe has changed dramatically – politically, economically and socially – since 1990, when the first CEE market was entered in former Czechoslovakia. VIG also changed dramatically in the past 25 years, growing into a corporate group of international scale. It’s position today is clearly shown by a breakdown of premiums written. While EUR 500 million, or approximately 20%, of Group premiums were generated outside of Austria in 2000, the percentage today is greater than 50%. But it is not just the percentage that has changed, the magnitude has also increased greatly. The EUR 500 million in premiums that were generated outside of Austria have now become EUR 5 billion – in just ten years.

VIG growth potential

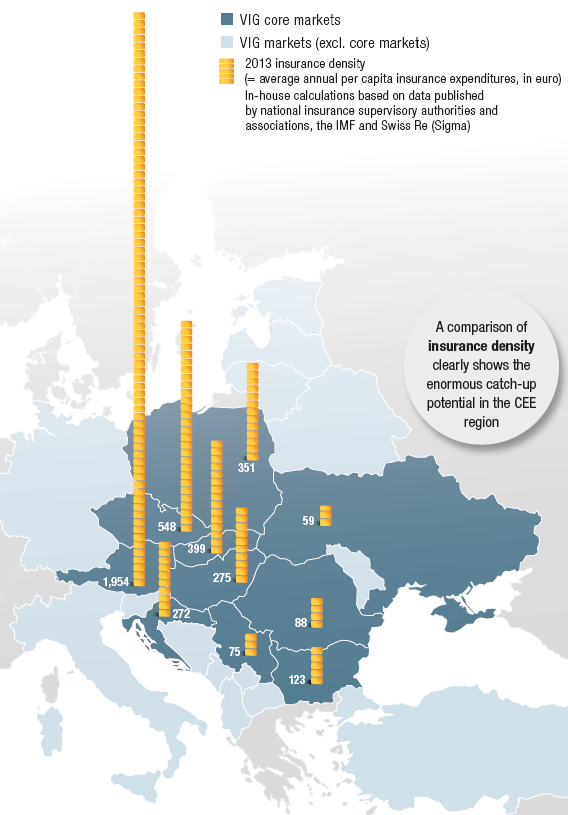

In spite of the catch-up process that has taken place to date, VIG markets still have considerable growth potential, as can be seen by comparing annual per capita insurance premiums (= insurance density) in the map above. VIG’s strong position – an overall market share of 19% makes it the clear number 1 in its core markets – will also enable it to take advantage of this potential.

VIG’s overall market share of 19% makes it No. 1 in its core markets

1st–3rd quarter 2014: Slovakia, Romania, Bulgaria, Serbia, Ukraine and total core markets

1st–4th quarter 2014: Austria, Czech Republic, Poland, Croatia, Hungary

|

Austria  Market ranking: #1 Premium volume: EUR 4,077.0 million Czech Republic  Market ranking: #1 Premium volume: EUR 1,683.4 million Slovakia  Market ranking: #1 Premium volume: EUR 727.0 million Poland  Market ranking: #4 Premium volume: EUR 1,034.1 million Romania  Market ranking: #1 EUR 339.7 million |

Bulgaria  Market ranking: #2 Premium volume: EUR 114.3 million Croatia  Market ranking: #4 Premium volume: EUR 90.9 million Serbia  Market ranking: #4 Premium volume: EUR 71.7 million Ukraine  Market ranking: #2 Premium volume: EUR 62.4 million Hungary  Market ranking: #7 Premium volume: EUR 180.0 million |