Hungary

Hungarian insurance market

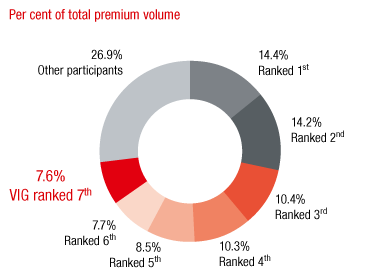

The top 5 insurance groups generated around 60% of the premium volume. The two largest insurance groups generated around 30%.

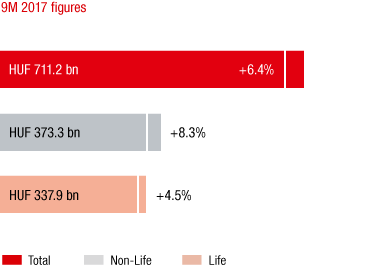

Market growth in the 1st to 3rd quarter of 2017 compared to the previous year

Source: National Bank of Hungary (MNB)

The Hungarian insurance market continued to grow in 2017. The insurance companies in the market increased premium volume by 6.4% in local currency terms in the first nine months of the year.

Premiums in the non-life sector were 8.3% higher year-on-year. This was primarily due to the motor third party liability line of business, which rose by 14.6%, mainly due to higher average premiums. The number of uninsured vehicles has decreased greatly in the last five years in Hungary (from 5.8% in 2012 to 1.8% in 2017). Motor own damage insurance grew 5.6%. Health insurance recorded very dynamic growth of 23.3%.

Market shares of the major insurance groups

Source: Hungarian Insurers Association (MABISZ); as of 2016

Life insurance premiums rose by 4.5%. Tax-privileged pension insurance continues to be popular and recorded a growth rate of 38%. Unit-linked and index-linked insurance, which represents more than half of all life premiums (51.2%), grew moderately at 1%.

The average per capita expenditure for insurance in Hungary was EUR 301 in 2016. Of this EUR 152 was spent for non-life insurance and EUR 149 for life insurance.

VIG companies in Hungary

With its three insurance companies Union Biztosító, Erste Biztosító and Vienna Life Biztosító Vienna Insurance Group held a market share of 7.6% in 2016, putting it in 7th place in the market. It is in 7th place in the non-life sector and 5th place in life insurance.

Vienna Insurance Group began the process of merging all three Hungarian insurance companies in 2017. The merger is expected to be concluded by the end of March 2018. After the merger, Vienna Insurance Group will only be represented by the insurance company Union Biztosító. The merger will give the Group an operating size in Hungary that ensures more effective operations and helps achieve the goal of a market share of around 10% in the medium term.

Business development in Hungary in 2017

Premium development

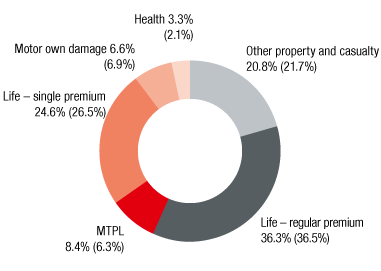

PREMIUMS by line of business

Values for 2016 in parentheses

The Hungarian Group companies wrote EUR 246.7 million in premiums in 2017 (2016: EUR 224.2 million). This corresponds to a year-on-year increase of 10.0%, which was primarily due to strong premium growth in motor third party liability and regular premium life insurance. Net earned premiums were EUR 192.1 million in 2017, 10.1% higher than the previous year.

Expenses for claims and insurance benefits

Vienna Insurance Group had expenses for claims and insurance benefits (less reinsurance) of EUR 142.6 million in Hungary in 2017 (2016: EUR 132.4 million). The 7.7% year-on-year increase was less than the increase in premiums, primarily due to the growth in motor third party liability insurance.

Acquisition and administrative expenses

Vienna Insurance Group acquisition and administrative expenses rose by 9.6% in Hungary to EUR 41.9 million in 2017 (2016: EUR 38.3 million), which generally corresponded to the increase in premiums.

Result before taxes

Hungary generated a result before taxes of EUR 2.1 million in 2017 (2016: EUR 3.8 million). The reduction was due to a EUR 2.9 million impairment of the Vienna Life insurance portfolio. The change in the combined ratio, on the other hand, had a positive effect.

Combined Ratio

The combined ratio improved significantly to 98.9% in 2017, mainly due to the growth in motor third party liability insurance (2016: 103.6%).

in EUR millions |

2017 |

2016 |

2015 |

2014 |

Premiums written |

246.7 |

224.2 |

204.3 |

180.0 |

Motor own damage insurance (Casco) |

16.3 |

15.5 |

14.9 |

13.3 |

Motor third party liability insurance |

20.6 |

14.0 |

10.7 |

10.6 |

Other property and casualty insurance |

51.3 |

48.6 |

46.0 |

44.0 |

Life insurance – regular premium |

89.6 |

81.8 |

77.4 |

58.6 |

Life insurance – single premium |

60.7 |

59.4 |

51.8 |

52.1 |

Health insurance |

8.2 |

4.8 |

3.6 |

1.4 |

Result before taxes |

2.1 |

3.8 |

-22.1 |

3.0 |