Turkey/Georgia

Turkey

The Turkish insurance market grew 14.7% year-on-year in local currency terms in the first three quarters. The Turkish insurance market continues to be dominated by the non-life sector, which represents around 85% of the total market. While the non-motor lines of business rose by 21.5% compared to the same period in the previous year, the motor lines of business showed a mixed picture, with motor third party liability decreasing 3.7%, and motor own damage increasing 10.3%. The life sector recorded an increase of 49.2%.

More than 60 insurance companies were operating in the Turkish insurance market as of 30 September 2017. The non-life insurance company belonging to the Group, Ray Sigorta, holds 18th place in the Turkish insurance market with a market share of 1.5%.

Georgia

The Georgian insurance market is dominated by health insurance, which represents around 47% of total premium volume. Total premium volume grew 10% year-on-year in local currency terms in the first three quarters. The non-life sector as a whole, including health insurance, grew significantly at a rate of 10.9% compared to the same period in the previous year. This increase also reflects the strong growth recorded in the motor lines of business (motor third party liability +17.5%, motor own damage +21.7%). At 2.4% of total premium volume, motor third party liability insurance has played a minor role to date. The local insurance supervisory authority, however, is currently preparing a law to make motor third party liability insurance mandatory. Only foreign vehicles will be affected at the start, domestic vehicles will be included later. Life insurance premiums declined 14.3% in the 1st to 3rd quarter of 2017.

Vienna Insurance Group is represented by two companies in Georgia: GPIH and IRAO. Their combined market share of 30.0% puts them in second place in the Georgian insurance market. A total of 16 insurers operate in the market.

Business development in the Turkey/Georgia segment in 2017

Premium development

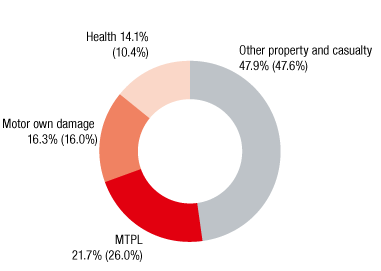

PREMIUMS by line of business

Values for 2016 in parentheses

VIG recorded total premiums written of EUR 207.8 million in the Turkey/Georgia segment in 2017 (2016: EUR 208.7 million), representing a decrease of 0.4% compared to the previous year. This change was due to negative currency effects, especially in Turkey. When adjusted for these effects, however, the Turkey/Georgia segment recorded an increase of 19.6%. Net earned premiums were EUR 101.6 million in 2017 (2016: EUR 102.1 million), a decrease of 0.5% compared to the previous year.

Expenses for claims and insurance benefits

Expenses for claims and insurance benefits less reinsurance were EUR 79.8 million in 2017 (2016: EUR 76.9 million). This corresponds to a year-on-year increase of 3.8% in expenses for claims and insurance benefits (less reinsurance), which was primarily the result of a higher volume of health insurance business in Georgia.

Acquisition and administrative expenses

Acquisition and administrative expenses in the Turkey/Georgia segment decreased from EUR 22.6 million in

2016 to EUR 19.7 million in 2017. This corresponds to a decrease of 12.8% compared to the previous year, mainly due to an exit from a local bank cooperation in Georgia.

Result before taxes

At EUR 9.4 million, the result before taxes was close to the level in the previous year (2016: EUR 9.0 million).

Combined Ratio

The combined ratio rose to 96.1% in 2017 (2016: 95.7%).

in EUR millions |

2017 |

2016 |

2015 |

2014 |

Premiums written |

207.8 |

208.7 |

182.3 |

170.4 |

Motor own damage insurance (Casco) |

33.9 |

33.2 |

36.5 |

33.7 |

Motor third party liability insurance |

45.1 |

54.4 |

34.8 |

27.3 |

Other property and casualty insurance |

99.5 |

99.4 |

90.3 |

87.5 |

Life insurance – regular premium |

0.0 |

0.0 |

0.0 |

0.0 |

Life insurance – single premium |

0.0 |

0.0 |

0.0 |

0.0 |

Health insurance |

29.3 |

21.8 |

20.8 |

21.9 |

Result before taxes |

9.4 |

9.0 |

3.2 |

5.7 |