Pension account stimulates demand

Wiener Städtische takes on a pioneer role for private pension provisions

“The introduction of the pension account in Austria creates clarity about individual pension needs – which are clearly substantial.”

Robert Lasshofer, General Manager of Wiener Städtische AG Vienna Insurance Group

What is your assessment of the introduction of the pension account in Austria?

Lasshofer: It used to be unclear to many people how large their government pensions would be, and it wasn’t easy to calculate. Effective 1 January 2014, the complex pensions models were replaced by a uniform system, the so-called pension account. All Austrians born after 1 January 1955, i.e. a majority of working people today, are affected. The advantages are clear. A virtual account allows people to see all their pension credits to date, practically at the click of a mouse. In my view, this creates perfect clarity about an individual’s government pension entitlement. And comparing this entitlement to current income makes one instantly aware of how big the notorious pension gap actually is. The gap needs to be filled – and this is where we come in.

Did introducing the pension account increase the demand in this area for Wiener Städtische?

Lasshofer: We increased premiums in all our business lines in 2014. Aside from the attention drawn to the pension account and, therefore, pension provisions, life insurance benefited mostly from a change to the law for single-premium products. As of 1 March 2014, the minimum tax lock-in period for people 50 years and older was reduced from 15 years to 10, leading to a significant increase in the premiums we received.

What specific measures did you take in 2014?

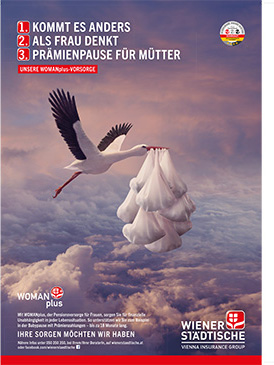

Lasshofer: We took advantage of current conditions and the intense public discussion to develop new pension products and increase the information we provide. Our “WOMAN plus” product, for example, was developed specifically for women’s pension needs, and it met with brisk demand after it was put on the market in 2014.

WOMAN plus. A product custom-tailored for the retirement needs of women.

Why specifically for women?

Lasshofer: The situations faced by men and women also differ with respect to personal pension provision. The lives of many women still revolve around raising children and working part-time. Even if they have full-time jobs, they earn less than men on average. As a result, the average pension received by women is 45% smaller than the pension received by men.

Can you imagine a life insurance policy without a guaranteed interest rate?

Lasshofer: Due to the current extremely low level of interest rates, the Austrian Financial Market Authority has reduced the maximum guaranteed interest rate for new life insurance policies from 1.75% to 1.5% starting at the beginning of 2015. However, life insurance still continues to be more attractive, for example, than a savings account. Although we currently have no plans to put a product on the market without a guarantee, we are monitoring national and international developments closely. The combination of a guaranteed interest rate and profit participation is still one of our customers’ major reasons for investing in life insurance. Eliminating this guarantee would therefore not be in the interests of our customers or their future pension needs.

Life insurance in Austria*

|

There were 9.8 million life insurance policies at the end of 2013, of which 7 million were traditional and 2.8 million were unit-linked life insurance. 42% of the policyholders indicated pension provision as their main reason for life insurance. 29% want the money to be inherited by their children, and 28% gave capital accumulation as their reason. |

On average, Austrians paid EUR 154 per month for retirement provisions in 2013, EUR 30 more than in 2011. 2.1% of Austria’s economic output went to private life insurance. The average for Western Europe is 4.5%. * 2013, source: Austrian Insurance Association |