Polish insurance market

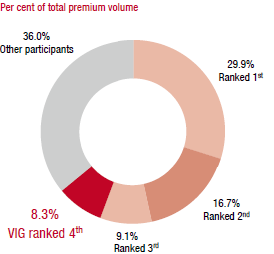

When expressed in euros, premium volume in Poland was around EUR 13 billion in 2014. This makes the country the largest insurance market in Central and Eastern Europe. Taken together, the top 5 insurance groups generated around 70% of total premium volume.

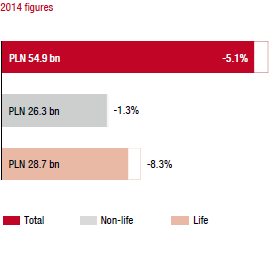

In local currency terms, total premium volume fell 5.1% year-on-year in Poland in 2014. In life insurance, the decrease was 8.3%. The loss of popularity was especially notable for short-term life insurance products, and was the main reason for the decrease. The decline in popularity was due to the lower level of interest rates, and tax law changes that came into effect in 2014. The positive growth achieved in non-life insurance in 2013 did not continue this year. The area recorded a decline of 1.3% in local currency terms in 2014, mainly due to performance in the motor vehicle sector (-3.3%). The price pressure remains very high in this line of business. Non-life products outside the motor vehicle lines of business, on the other hand, recorded an increase of 0.9%.

Insurance density was EUR 351 in Poland in 2013, of which EUR 161 was for non-life insurance and EUR 190 for life insurance.

Market growth in 2014

|

Market shares of the major insurance groups

|

VIG companies in Poland

Vienna Insurance Group operates six companies using five different brands in the Polish market. The VIG companies are Compensa Life and Non-life, InterRisk, Polisa, Benefia Non-life and the life insurer Skandia. Compensa Non-life also has branches in Latvia and Lithuania.

The acquisition of Skandia Poland was concluded in 2014 after receipt of official approval. Moreover, the two life insurers Compensa Life and Benefia Life were merged to form Compensa Life.

Vienna Insurance Group’s market share was 8.3% in 2014, making it the fourth largest insurance company in Austria. It also holds fourth place for both non-life and life insurance.