Slovakian insurance market

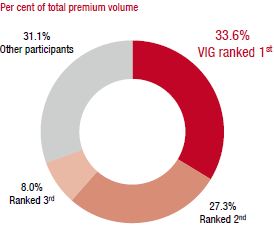

The Slovakian insurance market is dominated by two players that represent around 60% of total premium volume. Taken together, the top 5 insurance groups generated around 80% of market premiums in the 1st–3rd quarters of 2014.

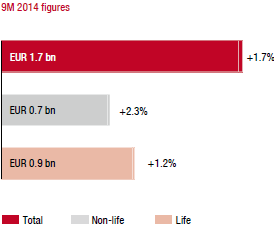

The Slovakian insurance market recorded a year-on-year increase of 1.7% in the first nine months of 2014. Life insurance grew by around 1.2% during this period. The sizeable increase recorded for single-premium products was a key factor in this growth. The Slovakian central bank reduced the guaranteed minimum interest rate from 2.5% to 1.9% at the beginning of 2014.

Motor vehicle insurance represents more than half of the Slovakian non-life insurance market. Due to continued strong competition premiums showed no growth in the motor vehicle sector, while non-life products outside the motor vehicle lines of business continued to grow at a rate of 5.2%. As a result, the overall increase in non-life premiums was 2.3%.

Average per capita expenditures for insurance in Slovakia were EUR 399 in 2013. EUR 172 of this amount was for non-life insurance and EUR 227 for life insurance.

Market growth in the 1st to 3rd quarters of 2014

|

Market shares of the major insurance groups

|

VIG companies in Slovakia

Vienna Insurance Group operates three insurance companies in the Slovakian market: Kooperativa, Komunálna and PSLSP.

VIG’s market share of 33.6% makes it the largest insurance group in the country. It also holds first place in the area of life and motor vehicle insurance.