Business development in Austria in 2014

Premiums written Austria

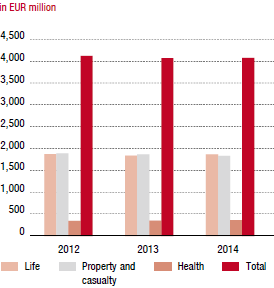

Premium development

The Austrian VIG companies wrote gross premiums of EUR 4,076.99 million in 2014, representing an increase of 0.1% compared to the previous year. EUR 2,338.81 million of the premium volume was contributed by Wiener Städtische, EUR 877.30 million by Donau Versicherung and EUR 860.88 million by s Versicherung. The above-average growth achieved by Wiener Städtische compensated for the optimisation measures that were needed for the Donau branch in Italy due to past claims experience. Net earned premiums rose by 0.7% in 2014, from EUR 3,348.48 million to EUR 3,370.79 million.

EUR 1,838.09 million of the premiums, or 45.1%, were written in the property and casualty area. This was a decrease of 1.8% compared to 2013, due to optimisation measures needed for the motor vehicle insurance business in Italy.

Life insurance represented EUR 1,870.74 million, or 45.9%, of Group premium volume in Austria, which rose 1.4% in 2014. The good performance achieved by Wiener Städtische in the area of single-premium group insurance contributed to this increase.

Health insurance generated 9.0% of the premium volume, or EUR 368.16 million. This corresponds to an increase of 3.0% compared to the health insurance premium income of EUR 357.43 million in 2013.

Expenses for claims and insurance benefits

Expenses for claims and insurance benefits less reinsurance fell compared to the previous year from EUR 3,338.29 million to EUR 3,320.21 million in 2014. This represents a decrease of 0.5%.

Acquisition and administrative expenses

The Austrian Vienna Insurance Group companies had acquisition and administrative expenses of EUR 627.21 million in 2014, representing an increase of 3.3% compared to 2013.

Profit before taxes

Profit before taxes declined by 27.8% in Austria to EUR 169.73 million in 2014 (2013: EUR 235.09 million). The decrease is primarily due to the write-down of Hypo Alpe Adria bonds.

Combined ratio

Although the combined ratio in Austria (after reinsurance, not including investment income) improved to 99.9% in 2014 (2013: 101.4%), it is still being negatively affected by the high reserve ratio and expenses in Italy.

Vienna Insurance Group in Austria

| XLS Download |

|

2014 |

2013 restated |

2012 |

in EUR million |

|

|

|

Premiums written |

4,076.99 |

4,073.88 |

4,122.53 |

Life |

1,870.74 |

1,844.52 |

1,878.33 |

Property and casualty |

1,838.09 |

1,871.93 |

1,896.65 |

Health |

368.16 |

357.43 |

347.55 |

Profit before taxes |

169.73 |

235.09 |

295.98 |