Czech Republic

Czech insurance market

The Czech insurance market has a high level of market concentration. The top 5 insurance groups generated around 85% of market premiums in the 1st to 3rd quarter of 2017, with the two largest insurance groups generating around 62%.

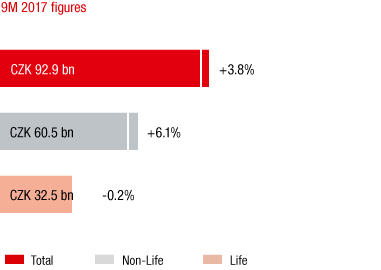

Market growth in the 1st to 3rd quarter of 2017 compared to the previous year

Source: Czech Insurance Association

In the first three quarters of 2017, premiums in the Czech Republic increased by 3.8% based on local currency.

This increase was primarily due to the non-life sector, which recorded strong growth of 6.1% compared to the same period in the previous year. Motor premiums rose by 5.9% (motor third party liability +3.6%, motor own damage +8.9%). This was a continuation of the growth trend in this segment caused by a steady increase in the number of vehicles insured. The non-motor lines of business also recorded strong growth of 6.4%.

Life insurance fell slightly by 0.2% based on local currency. The single premium business decreased by 15.7% in the 1st to 3rd quarter of 2017, while regular premium life insurance rose by 0.3%.

A per capita average of EUR 504 was spent on insurance premiums in the Czech Republic in 2016. EUR 300 of this amount was for non-life insurance and EUR 204 for life insurance. The economic outlook continues to show good growth opportunities in the Czech Republic. A high employment rate and rising real wages are stimulating personal consumption and the demand for insurance products.

VIG companies in the Czech Republic

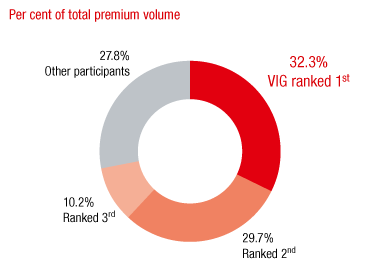

Market shares of the major insurance groups

Source: Czech Insurance Association; as of 9M 2017

Vienna Insurance Group operates three insurance companies in the Czech Republic: Kooperativa, ČPP and PČS. The Group has also had its own reinsurance company, VIG Re, in Prague since 2008, but this company is allocated to the Central Functions in the reporting segment.

With a total market share of 32.3%, the VIG companies hold first place in the market ranking of leading insurance groups in the country. VIG is the clear number 1 in the life sector in the Czech Republic is ranked second in the non-life sector of the market.

VIG plans to merge its Group companies Kooperativa and PČS as of 1 January 2019, subject to approval by the local authorities and the boards of the companies. The aim is to strengthen the bank insurance business by combining the expertise of the two companies.

Business development in the Czech Republic in 2017

Premium development

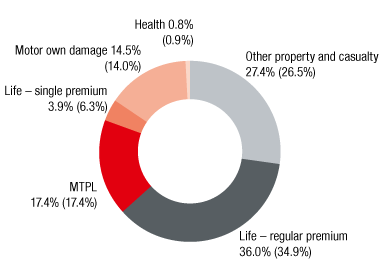

Premiums by line of business

Values for 2016 in parentheses

The Czech Group companies wrote EUR 1,603.2 million in premiums written in 2017 (2016: EUR 1,529.1 million), representing an increase of 4.9% compared to the previous year. The large increase was mainly due to good performance in the regular premium life insurance and other property and casualty business. Net earned premiums were EUR 1,206.7 million in 2017 (2016: EUR 1,151.5 million).

Expenses for claims and insurance benefits

Expenses for claims and insurance benefits less reinsurers’ share were EUR 792.0 million in 2017. The year-on-year increase of 7.3% was primarily due to a number of large losses in other property and casualty and in the indirect business as well as an increase in motor claim payments. There was also an increase in the number of adverse weather events in 2017.

Acquisition and administrative expenses

Acquisition and administrative expenses of the Czech Group companies increased 3.0% to EUR 361.4 million in 2017. Acquisition and administrative expenses were still EUR 350.8 million in 2016. Higher commission expenses due to premium growth were the main reason for the increase.

Result before taxes

Due to the negative change in the combined ratio, the result before taxes generated by the Czech Group companies declined by 2.2% year-on-year to EUR 149.3 million in 2017 (2016: EUR 152.8 million). However, the negative effect of the change in the combined ratio was almost offset by a significant improvement in the life insurance underwriting result.

Combined Ratio

In spite of the developments indicated in the expenses for claims and insurance benefits section and the deteriorating trend in motor third party liability insurance, the combined ratio of 97.5% continued to be below the 100% threshold in 2017 (2016: 90.5%).

in EUR millions |

2017 |

2016 |

2015 |

2014 |

Premiums written |

1,603.2 |

1,529.1 |

1,554.8 |

1,683.4 |

Motor own damage insurance (Casco) |

232.7 |

213.4 |

190.3 |

177.7 |

Motor third party liability insurance |

278.4 |

266.1 |

256.8 |

256.1 |

Other property and casualty insurance |

438.8 |

405.2 |

377.4 |

379.1 |

Life insurance – regular premium |

576.7 |

534.0 |

507.6 |

487.2 |

Life insurance – single premium |

63.3 |

97.0 |

209.1 |

369.5 |

Health insurance |

13.3 |

13.4 |

13.6 |

13.8 |

Result before taxes |

149.3 |

152.8 |

163.0 |

177.9 |