Poland

Polish insurance market

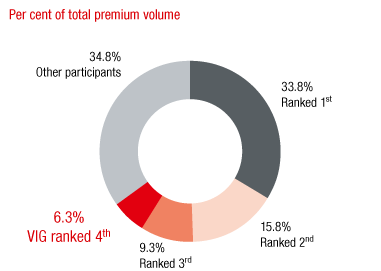

The Polish insurance market is one of the largest in Central and Eastern Europe. The top 5 insurance groups in the country generated around 70% of the premiums in the 1st to 3rd quarter of 2017.

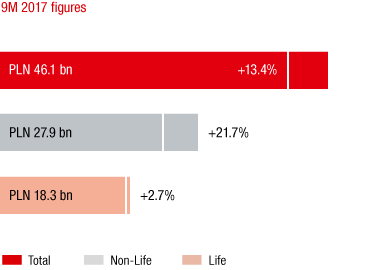

Market growth in the 1st to 3rd quarter of 2017 compared to the previous year

Source: Financial Market Authority Poland

A favourable turnaround occurred in Poland in the first nine months of 2017. After a small decrease in premium volume in the previous year, premiums increased 13.4% year-on-year based on local currency.

Premiums grew 21.7% in the non-life sector. The motor lines of business were the main driver of this change, recording large increases of 38.7% for motor third party liability and 18.0% for motor own damage insurance. Higher average premiums improved the profitability of insurers in the motor third party liability line of business, which had suffered for years. The non-motor lines of business recorded a 10.1% growth.

Market shares of the major insurance groups

Source: Financial Market Authority Poland; as of 9M 2017

Life insurance premiums rose a moderate 2.7% in the 1st to 3rd quarter of 2017. Single premium products rose by 8.0% year-on-year. Regular premium life insurance remained almost unchanged with an increase of 0.3% compared to 2016, while unit-linked life insurance became attractive again (+10.2%).

The interest in private supplementary health insurance is increasing in Poland. Poland has also become an important centre for modern IT solutions in recent years, including in the insurance industry. The Polish know-how in this area is attracting international companies and promoting investment in research and development.

Poland had an insurance density of EUR 338 in 2016. Of this, EUR 194 was spent on non-life insurance and EUR 144 on life insurance.

VIG companies in Poland

Five VIG insurance companies are operating on the Polish market: Compensa Life and Non-Life, InterRisk, Polisa and Vienna Life. Together they have a market share of 6.3%, which puts them in fourth place in the Polish insurance market. The Group is also ranked fourth in the non-life and life sectors.

Business development in Poland in 2017

Premium development

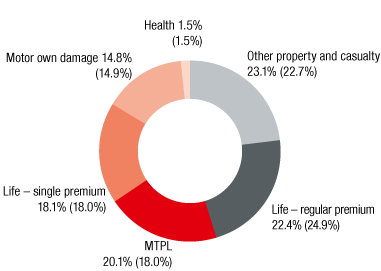

Premiums by line of business

Values for 2016 in parentheses

VIG generated total premiums written of EUR 886.6 million in Poland in 2017 (2016: EUR 819.2 million), representing an increase of 8.2% compared to the previous year. The significant increase was mainly due to good performance in motor third party liability and other property and casualty insurance. Net earned premiums were EUR 716.3 million in 2017, 7.0% higher than in 2016.

Expenses for claims and insurance benefits

The Polish VIG companies had expenses for claims and insurance benefits (less reinsurance) of EUR 532.3 million in 2017 (2016: EUR 542.6 million). This was a decrease of EUR 10.3 million or 1.9% in expenses for claims and insurance benefits (less reinsurance). It must be noted that the result of the previous year was greatly reduced by a change in the cancellation terms for the surrender of certain life insurance products and associated provisions.

Acquisition and administrative expenses

The Polish VIG companies managed to keep acquisition and administrative expenses at EUR 158.8 million in 2017, which is almost the same level as the previous year (2016: EUR 158.5 million).

Result before taxes

Result before taxes increased to 35.5 million in Poland in 2017 due to positive performance of the motor portfolio (2016: EUR 1.9 million). The increase was also partly due to the change in cancellation terms for the life lines of business in 2016 that was previously mentioned above.

Combined Ratio

The combined ratio also improved to an excellent 93.9% in 2017 due to positive performance of the motor lines of business (2016: 99.4%).

in EUR millions |

2017 |

2016 |

2015 |

2014 |

Premiums written |

886.6 |

819.2 |

838.9 |

1,034.1 |

Motor own damage insurance (Casco) |

131.3 |

122.3 |

125.3 |

140.9 |

Motor third party liability insurance |

177.9 |

147.6 |

150.8 |

177.9 |

Other property and casualty insurance |

205.2 |

185.5 |

186.8 |

221.3 |

Life insurance – regular premium |

198.3 |

204.2 |

210.9 |

157.6 |

Life insurance – single premium |

160.4 |

147.0 |

153.5 |

322.6 |

Health insurance |

13.5 |

12.6 |

11.6 |

13.9 |

Result before taxes |

35.5 |

1.9 |

20.8 |

53.4 |