Remaining CEE

The Remaining CEE segment includes the countries of Albania incl. Kosovo, Bosnia-Herzegovina, Croatia, Macedonia, Moldova, Serbia and Ukraine. The Remaining CEE markets generated 3.8% of Group premiums in 2017. The companies in the Montenegro and Belarus markets were not included in the VIG consolidated financial statements.

Albania including Kosovo

The Albanian insurance market grew 11.4% year-on-year in local currency terms in the first three quarters of 2017. At a share of more than 92%, the insurance market is dominated by the non-life sector, and motor third party liability in particular. Motor third party liability recorded a significant increase of 11.1%, while motor own damage insurance declined 1.2%. Life insurance premiums rose by 28.8%. In Kosovo, insurance premiums in the non-life sector rose by 2.5% in the 1st to 3rd quarter of 2017.

VIG operates two insurance companies, Sigma Interalbanian and Intersig, in the non-life sector in Albania. Sigma Interalbanian also has a branch in Kosovo. VIG’s market share of 23.7% puts it in second place in the Albanian insurance market.

Bosnia-Herzegovina

Premiums increased 8.1% in local currency terms in Bosnia-Herzegovina in the first three quarters of 2017. The non-life market grew 7.6% year-on-year, and life insurance grew somewhat faster at a rate of 9.9%. Motor third party liability insurance, which dominates the non-life sector, grew 7.9%.

Vienna Insurance Group has been represented by Wiener Osiguranje, headquartered in Banja Luka, in the Serbian Republika Srpska in Bosnia-Herzegovina since 2011. It has a market share of 5.5%. Based on data for the 1st to 3rd quarter of 2017, the acquisition of Merkur Osiguranje, which was signed at the end of October, would increase VIG’s market share to 9.8% moving it from seventh place into the top 3. This step expands Vienna Insurance Group’s regional presence by increasing its activities in the federation Bosnia-Herzegovina, and also expands its product portfolio by increasing activities in the life sector.

Croatia

Increases were recorded in both the non-life sector, which grew 3.4%, and the life sector, which rose slightly by 0.9% in the first three quarters of 2017 compared to the same period in the previous year. The overall market grew 2.6% in local currency terms. The motor lines of business showed a mixed picture. While premiums in the motor third party liability line of business decreased 0.7%, they increased 8.0% for motor own damage insurance.

VIG’s market share of 8.5% puts it in fourth place in the Croatian insurance market. It holds sixth place in the non-life sector and third place in life insurance. In December 2017, the Group adopted a resolution to merge the life insurance company Erste Osiguranje, which specialises in bank distribution, with the composite insurer Wiener Osiguranje, subject to approval by the local authorities. After the planned fusion has been concluded, Vienna Insurance Group will be represented in the Croatian insurance market solely by the insurance company Wiener Osiguranje. The “Erste Osiguranje” brand will be retained for the bank insurance business.

Macedonia

Premiums increased moderately by 2.7% in local currency terms in the Macedonian insurance market during the 1st to 3rd quarter of 2017. Non-life insurance dominates the overall market with around 86% of premium volume. Starting from a smaller base, the life sector recorded strong year-on-year growth of 14.9%, while the non-life market increased slightly compared to the previous year with an increase of 0.9%. This was mainly due to the decrease in premiums in the non-motor lines of business.

Vienna Insurance Group is represented by three companies, Winner Non-Life, Winner Life and Makedonija Osiguruvanje, in the Macedonian insurance market, where its market share of 21.3% makes it a market leader. VIG holds first place in the non-life sector and third place in the life sector.

Moldova

The Moldovan insurance market is dominated by the non-life sector, and the motor lines of business in particular. Non-life insurance generates around 94% of the premium volume in the country. The Moldovan insurance market grew 5.2% in local currency terms in the 1st to 3rd quarter of 2017, with the non-life sector increasing 5.0% and the life sector 7.9%. The growth in the non-life sector was driven by the motor lines of business, which recorded a year-on-year premium increase of 7.3%, while the non-motor lines of business fell 1.9%.

VIG has been represented in the country by Group company Donaris since 2014. The company’s market share of 14.7% now makes it the leading insurance company in Moldova.

Serbia

Premiums in the Serbian insurance market rose by 7.4% year-on-year in local currency terms in the first three quarters of 2017. This growth was primarily generated by the non-life sector, which increased 8.6%. Life insurance increased 3.7% in the 1st to 3rd quarter of 2017. Even though the rate of growth slowed compared to previous years, life insurance continued its long-term upward trend in 2017.

Vienna Insurance Group was focusing on its market presence in Serbia when it merged Group company Wiener Städtische Osiguranje with the two AXA companies that had been acquired seven months earlier in the previous year. As a result of the merger, it achieved a market share of 11.9% in the first three quarters of 2017. This puts it in fourth place in the Serbian insurance market. Vienna Insurance Group holds fourth place in the non-life sector and second place in life insurance.

Ukraine

The Ukrainian insurance market is dominated by non-life insurance (> 90% of premium volume) and exhibits a small, but rising, level of market concentration in the non-life sector – the ten leading insurers have a market share of around 40%. The overall market grew 26.4% in local currency terms in the first three quarters of 2017. Reinsurance between the local companies in the non-life sector played a major role in this. Direct premiums rose by 7.3% after adjusting for this effect. In spite of a price war and commission dumping, premiums rose by 8.0% year-on-year in the non-life sector. This growth was driven by increases in motor, accident, health and general third party liability insurance. Life insurance premiums rose moderately by 1.7%.

Vienna Insurance Group operates three non-life insurance companies, UIG, Kniazha and Globus, and the life insurance company Kniazha Life in the Ukrainian insurance market. It holds a market share of 3.8%, which puts it in fourth place in the ranking of leading insurance groups in the country. VIG holds fifth place in the non-life sector and sixth place in the life sector.

Business development in the Remaining CEE segment in 2017

Premium development

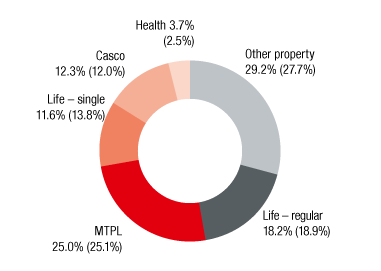

PREMIUMS by line of business

Values for 2016 in parentheses

The VIG companies in the Remaining CEE countries wrote EUR 352.0 million in premiums in 2017 (2016: EUR 331.4 million). The increase of 6.2% compared to the previous year was mainly due to positive performance in other property and casualty insurance in Croatia and Serbia and good performance in motor third party liability in Serbia. Net earned premiums were EUR 247.2 million in 2017 (2016: EUR 232.9 million), an increase of 6.1% compared to the previous year.

Expenses for claims and insurance benefits

Expenses for claims and insurance benefits less reinsurance were EUR 170.6 million in 2017 (2016: EUR 161.8 million). This represented a year-on-year increase of 5,4% in expenses for claims and insurance benefits (less reinsurance), which was less than the growth in premiums in spite of increased Green Card losses in Ukraine.

Acquisition and administrative expenses

Acquisition and administrative expenses were EUR 93.3 million in the Remaining CEE segment in 2017 (2016: EUR 83.3 million). The increase of 12.0% was the result of a significant increase in commissions in Serbia due to higher premiums and a change in distribution structure.

Result before taxes

The loss of EUR 6.0 million reported in reporting year 2017 was due to a total of EUR 19.5 million in goodwill impairment in the Ukraine, Moldova and Albania incl. Kosovo CGU groups. This segment had a result before taxes of EUR 7.4 million in 2016. When adjusted for goodwill impairment in both years, the result for 2017 was close to the level in 2016.

Combined Ratio

The combined ratio improved slightly compared to the previous year, although at a level of 100.1% it was still above the 100% mark in 2017 (2016: 101.4%).

in EUR millions |

2017 |

2016 |

2015 |

2014 |

Premiums written |

352.0 |

331.4 |

307.2 |

293.6 |

Motor own damage insurance (Casco) |

43.5 |

39.6 |

39.6 |

42.7 |

Motor third party liability insurance |

88.0 |

83.3 |

83.0 |

77.3 |

Other property and casualty insurance |

102.9 |

91.8 |

83.4 |

77.2 |

Life insurance – regular premium |

64.0 |

62.6 |

64.5 |

65.9 |

Life insurance – single premium |

40.7 |

45.8 |

28.8 |

22.7 |

Health insurance |

12.9 |

8.1 |

7.9 |

7.8 |

Result before taxes |

-6.0 |

7.4 |

-25.4 |

11.3 |