Remaining CEE

The Remaining CEE segment includes Albania, Bosnia-Herzegovina, Croatia, Macedonia, Moldova, Serbia and Ukraine. The Remaining CEE markets generated 3.7% of Group premiums in 2016. The Group companies in the Montenegro and Belarus markets were not included in the VIG consolidated financial statements.

Albania including Kosovo

The Albanian insurance market grew 7.0% in local currency terms during the 1st to 3rd quarters of 2016. Liberalisation of motor rates, which led to an increase in prices for motor third party liability insurance, had a particularly positive effect. Premiums rose 8.9% for motor third party liability insurance and 26.3% for motor own damage insurance. Life insurance recorded a slight decrease of 3.0% compared to the previous year. Kosovo recorded premium growth of around 3% in the first three quarters of 2016.

VIG is represented by two non-life insurance companies, Sigma Interalbanian and Intersig, in Albania. Sigma Interalbanian also operates a branch in Kosovo. Vienna Insurance Group holds second place in the Albanian market, with a market share of 24.6%.

Bosnia-Herzegovina

The insurance market in Bosnia- Herzegovina grew by 7.9% in local currency terms in the first three quarters of 2016. The non-life area recorded a significant 8.8% increase in premiums. This was primarily due to growth in motor third party liability insurance. Life insurance premiums also recorded positive growth of 4.4%.

VIG is represented by the Group company Wiener Osiguranje in Bosnia-Herzegovina. VIG’s 5.2% share places it in seventh place in the market. It holds fifth place in non-life insurance and seventh place in life insurance.

Croatia

The Croatian insurance market grew 0.3% in the 1st to 3rd quarters of 2016. The non-life area recorded a 1.0% year-on-year increase, primarily due to good growth in the motor lines of business (+1.3%). Life insurance recorded a slight decrease of 1.2% in the first three quarters of 2016.

Vienna Insurance Group is represented by two companies in the Croatian market. Wiener Osiguranje is active both in life and non-life insurance while Erste Osiguranje specialises in life insurance business in cooperation with Erste Group. The Group has a market share of 8.5%, which puts it in fourth place in the Croatian insurance market. It holds sixth place in non-life insurance with a market share of 5.1% and third place in the life insurance market with 15.9%.

Macedonia

The Macedonian insurance market grew 4.9% year-on-year in local currency terms. The non-life segment, which generated 88% of total premiums and achieved an increase of 3.1% compared to the previous year, continued to be the most important driver for the insurance market. The life insurance area recorded an increase of 19.2%.

Vienna Insurance Group is represented by three Group companies in the Macedonian market – Winner Non-Life, Winner Life and Makedonija Osiguruvanje – and is the market leader with a share of 23.3%. Vienna Insurance Group also holds first place for non-life insurance and third place for life insurance.

Moldova

The Moldovan insurance market recorded significant growth of 11.6% in local currency terms during the 1st to 3rd quarters of 2016. Non-life premium volume increased 12.3%. Motor insurance made the largest contribution to this growth, increasing 16.3% compared to the same period in the previous year. Life insurance premiums rose 1.0% in the first three quarters of 2016.

Vienna Insurance Group is represented by the Group company Donaris in Moldova. Its acquisition in 2014 allowed VIG to open up the last country in the CEE region and extend its presence to 25 countries. VIG holds a market share of 14.4% in Moldova, putting it in second place in the market.

Serbia

Premium volume in the Serbian insurance market grew 10.0% year-on-year in local currency terms in the first three quarters of 2016. This increase was mainly due to premium growth in the non-life area, which rose 7.6% compared to the previous year. Life insurance premiums increased signifycantly by 18.9% in the 1st to 3rd quarters of 2016.

Vienna Insurance Group is represented in Serbia by Wiener Städtische Osiguranje, which operates in both the life and non-life areas. The purchase agreement for acquisition of the AXA Life and AXA Non-Life insurance companies was signed on 6 July 2016. These acquisitions increase VIG’s market share to around 12%. Vienna Insurance Group holds fourth place in non-life insurance and second place in life insurance.

Ukraine

Premiums written in Ukraine rose 14.4% year-on-year in local currency terms during the 1st to 3rd quarters of 2016. Non-life premiums increased 13.1%, in spite of strong price competition and commission dumping in the market. It must be noted, however, that the increase was mainly due to depreciation of the country’s currency and rate increases for motor third party liability insurance. Year-on-year growth of 32.2% was recorded in the life insurance area.

VIG is represented by four insurance companies in Ukraine: the three non-life insurance companies UIG, Kniazha and Globus and the life insurance company Kniazha Life, whose name was changed from Jupiter to Kniazha Life in September 2016. With a market share of 4.4%, VIG is in the third place in the Ukrainian insurance market. VIG holds third place in non-life insurance, and seventh place in life insurance.

Business development in the Remaining CEE segment in 2016

Premium development

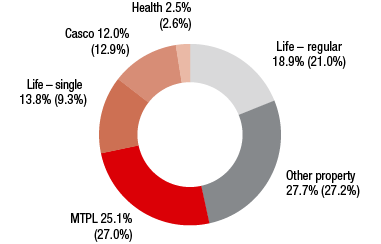

PREMIUMS WRITTEN BY LINE OF BUSINESS

Values for 2015 in parentheses

The VIG companies in the Remaining CEE countries wrote EUR 331.39 million in premiums written in 2016 (2015: EUR 307.19 million). The year-on-year increase of 7.9% was mainly the result of good growth in Croatia and Serbia. Net earned premiums were EUR 232.91 million in 2016 (2015: EUR 211.37 million), an increase of 10.2% compared to the previous year.

Expenses for claims and insurance benefits

Expenses for claims and insurance benefits less reinsureance were EUR 161.80 million in 2016 (2015: EUR 145.54 million). Compared to the previous year, this represented an increase of 11.2% in expenses for claims and insurance benefits, which primarily resulted from the transfer to the mathematical reserve due to the increase in premiums from single-premium business in Croatia and Serbia.

Acquisition and administrative expenses

Acquisition and administrative expenses were EUR 83.29 million in the Remaining CEE segment in 2016 (2015: EUR 81.71 million). Due to the low commission rates in single-premium business, the 1.9% increase in acquisition and administrative expenses was significantly smaller than the increase in premiums.

Result before taxes

Profit before taxes increased to EUR 7.43 million due to continued positive development of the VIG companies in the Remaining CEE countries. (2015: EUR -25.44 million). It must be noted, however, that the result in the previous year was negatively affected by EUR 38.7 million in goodwill impairment losses.

Combined ratio

The combined ratio improved slightly compared to the previous year to 101.4% in 2016 (2015: 102.7%).

in EUR million |

2016 |

2015 |

2014 |

Premiums written |

331.39 |

307.19 |

293.60 |

Motor own damage insurance |

39.61 |

39.64 |

42.73 |

Motor third party liability insurance |

83.35 |

82.97 |

77.26 |

Other property and casualty insurance |

91.85 |

83.41 |

77.22 |

Life insurance – regular premium |

62.64 |

64.47 |

65.92 |

Life insurance – single-premium |

45.83 |

28.83 |

22.71 |

Health insurance |

8.12 |

7.87 |

7.76 |

Result before taxes |

7.43 |

-25.44 |

11.31 |