Key strategic elements

Concentrating on the core business

Vienna Insurance Group has more than 190 years of experi ence in the insurance industry and uses this experience every day when dealing with its customers in Austria and the CEE region. The core business of Vienna Insurance Group is to know people’s country-specific security and future provision needs and offer individual insurance solutions that meet these needs. The Group will continue to use professional customer advisory services, a comprehensive range of products and outstanding service to achieve its success in the future.

Focus on Austria and the CEE region

With foresight, determination and due care, VIG took the opportunity to enter the CEE region 26 years ago, a decision that is still bearing fruit today. Around half of all the Group premiums written in financial year 2016 were generated in markets outside of Austria. The differences in economic and insurance maturity of these markets provides valuable diversification among growing and dormant markets.

In the case of Austria, the goal is to consolidate our market leadership. This will be achieved by promoting loyalty among existing customers and actively taking advantage of growth potential. The potential offered by life insurance will be further exploited, in spite of the challenges presented by the ongoing low interest rate environment. Austria has a lower insurance density in this area than other Western European countries. Local Vienna Insurance Group companies have repeatedly demonstrated in the past that they possess the experience and expertise needed to identify market developments at an early stage and address them with innovative insurance solutions. They must continue to further exploit these opportunities in the future to ensure that Austria remains a stable foundation for the Group.

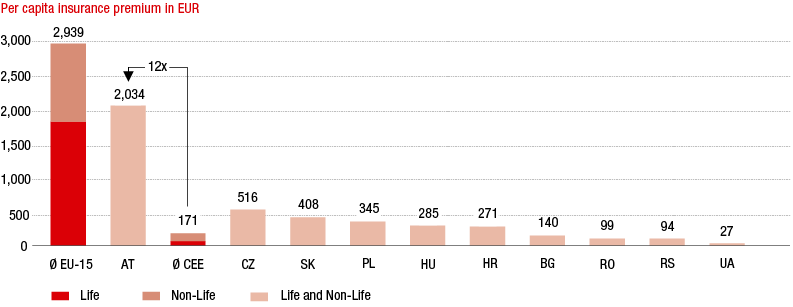

The early expansion into the CEE region gave the Group a decisive starting advantage. The valuable knowledge that the local employees possessed about special market features was quickly used to address local needs. The potential of the region, which Vienna Insurance Group continues to believe in, can be seen by comparing, for example, the insurance density in different countries. The average insurance density in the CEE markets was EUR 171, compared to EUR 2,939 in the EU-15 countries. The figures in the non-life area were EUR 113 versus EUR 1,138. The difference was even greater in the life segment, where the value was EUR 58 for the CEE markets and EUR 1,801 for the EU-15 countries.

INSURANCE DENSITY 2015

CEE: weighted average of CEE markets

Source: in-house calculations based on publications by national insurance supervisory authorities and associations, the IMF and Swiss Re (Sigma)

VIG companies in some countries once again provided impressive proof that they could take advantage of this potential in financial year 2016. The VIG companies in Romania, for example, reported an impressive 24% increase in premiums in 2016. In addition, Serbia recorded an increase of around 18%, Hungary around 10% and Croatia around 9%. The aim is to continue on this successful path in the coming years.