Romania

Romanian insurance market

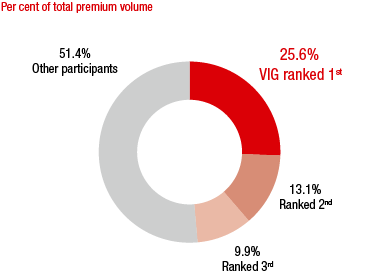

Market concentration is lower in Romania compared to other insurance markets in Central and Eastern Europe. The top 3 insurance groups generated close to 50% of total premiums in 2016.

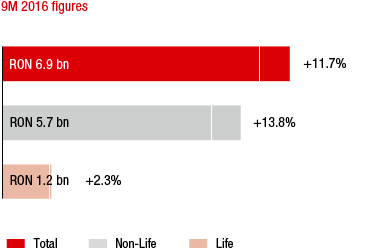

MARKET GROWTH IN THE 1ST TO 3RD QUARTERS OF 2016 COMPARED TO THE PREVIOUS YEAR

Source: Financial supervisory authority ASF

Premiums written in Romania rose 11.7% year-on-year in local currency terms in the 1st to 3rd quarters of 2016 – one of the fastest growth rates recorded in recent years. Non-life insurance, which grew 13.8% year-on-year, was mainly responsible for this increase. Premium growth of 33.7% for motor third party liability insurance easily compensated for the slight 9.0% decrease recorded in the non-motor lines of business. The increase in non-life insurance was primarily the result of higher average premiums in motor third party liability insurance, particularly for corporate customers.

Life insurance premiums grew 2.3% year-on-year in local currency terms. This increase was due to an increase in unit-linked and index-linked life insurance.

MARKET SHARES OF THE MAJOR INSURANCE GROUPS

Source: Financial supervisory authority ASF; as of 9M 2016

The average per capita expenditure for insurance was EUR 99 in Romania in 2015. EUR 78 of this amount was for non-life insurance and EUR 21 for life insurance. A comparison with other countries in the Central and Eastern European region, such as the Czech Republic, which had an average insurance density of EUR 516 in 2015, shows the enormous potential of the Romanian insurance market.

VIG companies in Romania

Vienna Insurance Group is represented by three insurance companies in the Romanian market: Omniasig, Asirom and BCR Life. A purchase agreement was also signed in August 2016 to acquire the life insurance company AXA Life. The buyers are the two Romanian VIG companies BCR Life and Omniasig. The acquisition is subject to approval by the local authorities.

With a market share of 25.6% in the 1st to 3rd quarters of 2016, Vienna Insurance Group is the leading insurance group in Romania. The Group is also the leader in non-life insurance and holds second place in the Romanian market for life insurance.

Business development in Romania in 2016

Premium development

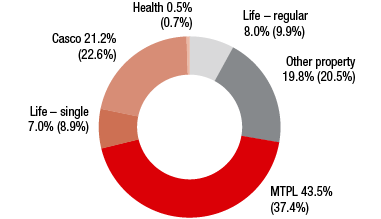

PREMIUMS WRITTEN BY LINE OF BUSINESS

Values for 2015 in parentheses

The Romanian Group companies wrote EUR 533.40 million in premiums written in 2016, representing a significant increase of 24.4% (2015: EUR 428.64 million). This increase was mainly due to an increase in new business and higher average premiums in motor third party liability insurance. Net earned premiums were EUR 351.13 million in 2016, 32.5% higher than the previous year.

Expenses for claims and insurance benefits

The Romanian companies had EUR 246.40 million in expenses for claims and insurance benefits (less reinsurance) in 2016 (2015: EUR 176.24 million). The year-on-year increase of 39.8% was primarily due to the allocation of loss reserves for motor third party liability insurance.

Acquisition and administrative expenses

Vienna Insurance Group had acquisition and administrative expenses of EUR 90.59 million in Romania in 2016 (2015: EUR 85.69 million). This year-on-year increase of 5.7% is due to a large increase in commissions caused by the significant increase in motor third party liability business.

Result before taxes

The Romanian Group companies increased their profit before taxes to EUR 3.51 million in 2016 (2015: EUR -87.58 million). It must be noted, however, that the result in the previous year was negatively affected by EUR 93.2 million in goodwill impairment losses.

Combined ratio

The combined ratio improved once again compared to the previous year, although at a level of 100.1%, it was still slightly above the 100% mark (2015: 102.4%).

in EUR million |

2016 |

2015 |

2014 |

Premiums written |

533.40 |

428.64 |

339.67 |

Motor own damage insurance |

113.20 |

96.93 |

83.80 |

Motor third party liability insurance |

231.88 |

160.33 |

116.42 |

Other property and casualty insurance |

105.36 |

87.89 |

84.95 |

Life insurance - regular premium |

42.48 |

42.31 |

35.63 |

Life insurance - single premium |

37.52 |

38.30 |

18.73 |

Health insurance |

2.95 |

2.88 |

0.14 |

Result before taxes |

3.51 |

-87.58 |

6.08 |