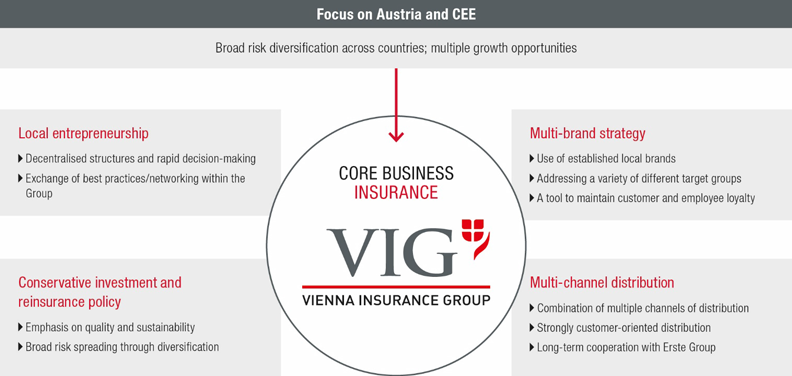

Management principles

Main Principles for achieving VIG’S Goals

Local entrepreneurship

VIG’s decentralised structure and rapid decision-making are important success factors. It intentionally relies on the expertise of its local management and employees, who know the needs of the local population the best.

This is because the region where VIG operates only appears homogeneous at first glance. Closer examination clearly shows the variation in structure and level of development in the different insurance markets. As a result, business models cannot simply be transferred from one country to another. Instead, distribution and products have to be modified to take account of the special features of each market. This special structure does, however, offer great opportunities for both local management and local employees, as it allows them to work independently. The higher-level values and principles defined at the Group level may not, however, be ignored. A particular focus is placed on the risk management, actuarial, reinsurance and investment areas, and the departments in the holding company assist the VIG companies in these areas while ensuring continuous development and communication of the top-level Group guidelines. Regular international meetings of management and employees are held to exchange best practice examples and promote a common corporate culture.

Multi-brand strategy

VIG operates with more than one company and brand in most of its markets. This multi-brand strategy and local entrepreneurship are the key characteristics that set VIG apart from the competition and form an important foundation for the success of the Group. As part of its expansion strategy, VIG decided to retain well-established brands that already enjoyed good customer recognition. This allows it to address different target groups and design different product portfolios. The Group companies use their local brand names as their first names, which strengthens their regional identity and employee loyalty to the company. At the same time, adding Vienna Insurance Group to the name proclaims its international stature and many years of experience and provides additional security to customers.

Vienna Insurance Group nevertheless focuses on taking advantage of potential synergies and continuously examines the economic use of resources and the efficiency of organisational structures for this purpose. In many countries, employees are already working successfully in shared services in order to perform administrative tasks more efficiently. Group companies are only merged if the potential synergies clearly outweigh the benefits of a diversified market presence.

Multi-channel distribution

Multi-channel distribution is directly related to the multi-brand strategy. VIG follows a diversified distribution strategy to acquire new customers in its markets, using a variety of different distribution channels including its own field sales staff, as well independent brokers and agents, multi-level marketing, direct sales, banks and digital media. These different distribution channels take into account local market circumstances in the countries and address customer needs in the best possible way.

The importance that a distribution channel has for a particular market depends both on the statutory framework and the state of development of the insurance industry in that market. Bank sales, for example, have become more important in recent years, and VIG was quick to recognise this trend. Erste Group and VIG entered into a cooperation agreement in 2008 that continues to benefit both parties to this day. VIG acquired all the insurance activities of Erste Group, a bank group that is firmly anchored in Austria and the CEE region, and the Erste Group sales organisation has distributed VIG products since then. In return, VIG companies offer their customers selected Erste Group banking products.

Conservative investment and reinsurance policies

The investment of customer funds entrusted to Vienna Insurance Group in the form of premiums is one of the key duties of the Company and demands great responsibility. Vienna Insurance Group’s investment strategy can be considered conservative. The strategy includes investment guidelines that are binding on every Group company and monitored by the Group Asset Management and Internal Audit departments at regular intervals. In addition to ensuring sufficient liquidity to satisfy insurance claims, particular importance is placed on diversifying the investment portfolio and on the returns that can be achieved while taking into account the overall risk exposure of the Company.

Vienna Insurance Group had EUR 36,236.20 million in investments (including cash and cash equivalents) at the end of 2016. Of this amount, 72.7% was invested in fixed income securities and loans, and 15.7% in real estate. Only 4.0% of total investments are in equities (including equities in the funds). (Detailed information on the structure of investments can be found on page 52.) Thanks to this balanced, risk-conscious investment strategy, the structure of investments was largely unaffected by the financial and economic crisis. It is nevertheless important to continue examining and optimising the structure of the investment portfolio in the future. Vienna Insurance Group maintained its risk-conscious investment strategy with practically no change in 2016. Full consolidation of the non-profit societies from the 3rd quarter of 2016 nevertheless caused a shift in the investment portfolio towards real estate and away from all other asset classes.

The conservative investment strategy plays a significant role, particularly taking into account the continuing low interest rates and ongoing obligations in the life insurance segment. These obligations will continue to be given the highest priority in the future with regard to investment. The life insurance companies in the Group are required to use appropriate control measures to ensure that this is the case. Internal analyses of maturity matching are performed regularly in the Group using current market parameters (yield curve).

Vienna Insurance Group also follows a conservative reinsurance policy. It limits the potential liability from its insurance business by passing on some of the risks it assumes to the international reinsurance market. It spreads this reinsurance coverage over a large number of different international reinsurance companies that Vienna Insurance Group believes offer adequate credit quality. VIG Holding acts as a reinsurer within the Group, coordinates the reinsurance programme and takes a leading role in the annual renewal process for natural disaster coverage.

The Group has had its own reinsurance company since the formation of VIG Re in 2008. The company is the first reinsurance company licensed in the Czech Republic and has a clear focus on the CEE region. The company began operations in August 2008 and received an A+ rating with stable outlook from the Standard & Poor’s rating agency in the same year. This rating was reconfirmed in the summer of 2016. VIG Re also follows a conservative investment strategy and reserving policy. The success of the business strategy is reflected by the steady increase incedents. VIG Re already has around 300 insurance companies as its customers.

Pooling different risks ensures an important balancing of risks at the Group level that in turn contributes to ensuring optimal external insurance protection for Vienna Insurance Group as a whole. The primary objective is to create a safety net to provide continuous protection for all of the companies in the Group against the negative effects of individual large losses and negative changes in entire insurance portfolios.