Bulgaria

Bulgarian insurance market

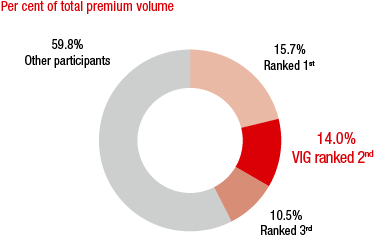

The five largest insurance groups in the Bulgarian market generated close to 60% of the premium volume in the first three quarters of 2016.

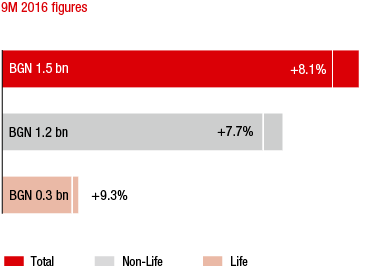

MARKET GROWTH IN THE 1st to 3rd quarters of 2016 COMPARED TO THE PREVIOUS YEAR

Source: Bulgarian Financial Supervision Commission (FSC)

The Bulgarian insurance market recorded year-on-year premium growth of 8.1% in local currency terms in the 1st to 3rd quarters of 2016.

Premium volume in the non-life area rose 7.7%, due to contributions from motor third party liability insurance (+7.6%), motor own damage insurance (+7.1%) and the non-motor lines of business (+8.5%).

Life insurance premiums increased 9.3% in local currency terms in the 1st to 3rd quarters of 2016. This increase wasmainly due to growth in traditional and tax-privileged savings products and health insurance, as well as unit-linked life insurance.

MARKET SHARES OF THE MAJOR INSURANCE GROUPS

Source: Bulgarian Financial Supervision Commission (FSC); as of 9M 2016

The per capita expenditure for insurance was around EUR 140 in Bulgaria in 2015. Of this, EUR 112 was spent on non-life insurance and EUR 28 on life insurance.

VIG companies in Bulgaria

Vienna Insurance Group is represented by three Group companies in Bulgaria: Bulstrad Life, Bulstrad Non-Life and Nova, which was formerly UBB-AIG. Bulstrad Non-Life acquired UBB-AIG in 2015 and changed its name to Nova in 2016 during integration with the Group. Vienna Insurance Group also holds an interest in the largest Bulgarian pension fund, Doverie.

The Group’s market share of 14.0% gives it an outstanding second place in the Bulgarian insurance market. VIG also holds second place in the life and non-life insurance markets in Bulgaria.

Business development in Bulgaria in 2016

Premium development

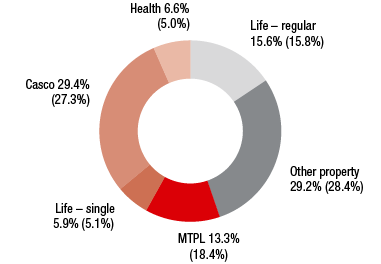

PREMIUMS WRITTEN BY LINE OF BUSINESS

Values for 2015 in parentheses

Premiums written in Bulgaria increased by 4.3% to EUR 136.68 million in 2016 (2015: EUR 131.08 million). The large growth rates recorded for health (+36.3%), motor own damage (+12.7%) and other property and casualty insurance (+7.0%) more than compensated for the decrease in motor third party liability premiums resulting from strong price competition in the market. Net earned premiums were EUR 96.51 million in 2016, 8.4% higher than the previous year.

Expenses for claims and insurance benefits

The Bulgarian VIG companies had EUR 59.27 million in expenses for claims and insurance benefits (less reinsurance) in 2016 (2015: EUR 57.89 million). Primarily due to growth in the marine business and motor own damage insurance, the 2.4% increase in insurance payments was considerably less than the increase in premiums.

Acquisition and administrative expenses

Acquisition and administrative expenses were EUR 32.03 million in 2016 (2015: EUR 29.56 million). This corresponded to an increase of 8.4% compared to the previous year, which was caused by an increase in commissions due to the growth in premiums and the first-time consolidation of Nova.

Result before taxes

The Bulgarian VIG companies contributed EUR 5.38 million to the total Group profit in 2016 (2015: EUR -2.35 million). The main reasons for the increase were a lower allowance for receivables than in the previous year and an improved underwriting result for Bulstrad Non-Life, as well as the first-time consolidation of Nova.

Combined ratio

The combined ratio improved significantly compared to the previous year to 98.2% in 2016 (2015: 102.3%).

in EUR million |

2016 |

2015 |

2014 |

Premiums written |

136.68 |

131.08 |

114.37 |

Motor own damage insurance |

40.24 |

35.69 |

30.21 |

Motor third party liability insurance |

18.17 |

24.08 |

21.76 |

Other property and casualty insurance |

39.86 |

37.24 |

34.59 |

Life insurance – regular premium |

21.33 |

20.75 |

19.87 |

Life insurance – single-premium |

8.08 |

6.71 |

7.94 |

Health insurance |

9.01 |

6.61 |

0.00 |

Result before taxes |

5.38 |

-2.35 |

2.08 |