Remaining markets

The Remaining Markets include Albania, Bosnia-Herzegovina, Bulgaria, Croatia, Estonia, Georgia, Germany, Hungary, Latvia, Liechtenstein, Lithuania, Macedonia, Moldova, Serbia, Turkey and Ukraine. The Remaining Markets generated 14.3% of Group premiums in 2015.

The Group companies in the Montenegro and Belarus markets were not included in the VIG consolidated financial statements.

Albania

The Albanian insurance market grew in 2015 by 21.4% on a local-currency basis. The 23.4% increase in premiums in the area of non-life insurance in comparison with the previous year is above all a result of a major increases in premiums in the motor insurance. This increase results from the corrective measures taken by the Albanian supervisory authority (AFSA) aimed at liberalising the motor tariffs. Consequently, the premiums in motor third party liability insurance increased by 22.5%, while those for motor own-damage insurance increased by 20.6%. Double-digit growth rates were also recorded in casualty and health insurance. Life insurance in 2015 remained at the same level as the previous year.

VIG is active in the Albanian market through two non-life insurance companies: Sigma Interalbanian and Intersig. Sigma Interalbanian also has a branch in Kosovo. VIG holds second place in the Albanian market, with a market share of 26.3%.

Bosnia-Herzegovina

The insurance market in Bosnia-Herzegovina grew by 4.7% in local currency in 2015. Premiums increased in the area of non-life insurance by 3.9%. This was primarily a result of positive development in motor third party liability insurance. Life insurance also developed in a dynamic way, reporting growth of 7.9% in 2015.

VIG is represented by the Group company Wiener Osiguranje in Bosnia-Herzegovina. VIG’s 5.4% share of total premium volume places it in 7th place in the market.

In non-life insurance, it is in 4th place, and in 8th place for life insurance.

Bulgaria

The Bulgarian insurance market recorded premium growth in the 1st–3rd quarter of 2015 of 9.7% compared to the same period of the previous year on a local-currency basis. Premiums in non-life insurance rose by 6.9%. Overall, life insurance recorded an increase of 22.0%, with tax-privileged savings products, risk products, and unit-linked life insurance experiencing the most positive performance.

Vienna Insurance Group is represented by two Group companies in Bulgaria, Bulstrad Life and Bulstrad Non-Life. The Group occupies very safe 2nd place in the Bulgarian insurance market. In June 2015, Bulstrad Non-Life entered into an agreement to acquire a 100% stake in the company UBB-AIG and conclude a cooperation agreement with United Bulgarian Bank (UBB). After receiving regulatory approval in January 2016, the name of UBB-AIG was changed to Insurance Company Nova Ins EAD (Nova). In addition, Bulstrad Non-Life acquired the remaining shares of its subsidiary Bulstrad Life in December 2015, thereby gaining full control.

Germany

The premium volume in the German insurance market in 2015 remained at the same level as in 2014. Property and casualty insurance reported 2.7% higher premium income in 2015. Premiums specifically in life insurance were characterised by the effects of the continuing low interest rate environment on the single premium business. While regular premium products remained stable (+0.3%), single premium business declined by 8.8%. This resulted in an overall decline in the life insurance market by 2.6%.

VIG is represented by two Group companies in Germany, InterRisk Non-Life and InterRisk Life. Both companies operate purely as brokers insurers. InterRisk Non-Life specialises in casualty and liability insurance and selected property insurance products. InterRisk Life focuses on retirement provision and occupational disability solutions, as well as protection for surviving dependants. Both VIG companies are still successful in the German market as profitable niche providers.

Estonia, Latvia and Lithuania

The positive growth trend in the Baltic States continued in 2015. All three Baltic States displayed significant premium growth. Estonia reported an increase in 2015 of 9.7% compared with the same period last year. Growth in Latvia was similarly high in the 1st–3rd quarter of 2015, at 7.3% and in Lithuania at 6.9%. Life insurance reported particularly dynamic growth in all three markets.

In Estonia, the VIG is active via the Group company Compensa Life, which is also represented by branches in Latvia and Lithuania. In 2015, the non-life insurance company Compensa Vienna Insurance Group, UADB, known as Compensa Non-life, was also formed, which is headquartered in Lithuania and handles the business formerly controlled from Poland. It maintains branches in Latvia and Estonia. By purchasing the Latvian non-life insurer “Baltikums Vienna Insurance Group“ AAS, abbreviated to “Baltikums”, VIG has acquired a majority stake in another company in Latvia. Baltikums operates a branch in Lithuania, whereas in Estonia, insurance products are sold through brokers. A majority interest was also acquired in BTA Baltic in Latvia towards the end of the year. The acquisition took place subject to necessary official approvals. The acquisition of BTA Baltic Insurance Company AAS, known as BTA Baltic, makes VIG one of the top 3 insurers in the non-life insurance market in the Baltic States.

Georgia

The insurance market in Georgia in the 1st–3rd quarter of 2015 recorded a significant increase of 29.4% in premium volume. Despite the dissolution of the national health insurance programme and a resulting decline in this class of insurance, the share of health insurance in the total premium volume totals around 45%. All lines of business were able to record positive growth in local currency compared with the same period of last year. The non-life area increased by 27.9%, the life area increased by 59.2% and health insurance increased by 17.2%.

A total of 14 insurance companies operate in the Georgian market. VIG is represented by two companies, IRAO and GPIH, which together, occupy the second place in the market, with a total market share of 27.7%.

Croatia

In 2015, the Croatian insurance market grew by 1.9% in local currency. Life insurance recorded an overall increase of 11.2%. This positive development was above all a contribution of the unit-linked products, with an increase of 77.1% in comparison with the previous year. In the area of non-life insurance, negative development in motor third party liability insurance resulted in a decline of 2.2%. Motor own-damage insurance, on the other hand, increased by 10.7% in 2015.

Vienna Insurance Group is represented by two companies in Croatia. Wiener Osiguranje is active both in life and non-life insurance while Erste Osiguranje specialises in life insurance business in cooperation with Erste Group. The Group ranks fourth in the Croatian insurance market with the share of 8.2%. In life insurance, it has a market share of 14.9%, putting it in the third place. In the area of non-life insurance, it is in the sixth place, with 4.8%.

Liechtenstein

Liechtenstein benefits from a central location that gives it unique access to the European Economic Area and Swiss market. As a result, the insurance companies located there offer international insurance solutions. At the end of 2015, 21 life insurance, 17 property and casualty insurance and 3 reinsurance companies had registered offices in Liechtenstein. The provisional figures for the market as a whole lead to an expectation of a slight decline in the level of premium income in 2015.

Vienna Insurance Group is represented by Vienna-Life in Liechtenstein. Vienna-Life operates exclusively in life insurance and concentrates predominantly on unit-linked and index-linked life insurance.

Macedonia

In comparison with the previous year, the Macedonian insurance market grew on a local-currency basis by 7.8%. With an 89.0% share in total premium volume and a 6.3% increase in premiums in comparison with the previous year, non-life insurance remains the major growth driver in this market. The life insurance area in Macedonia remains very underdeveloped, but the largest growth rate was achieved here, with an increase of 21.7%.

VIG is represented by three Group companies in the Macedonian market: Winner Non-Life, Winner Life, and Makedonija Osiguruvanje. It is the market leader, with a share of 21.3%. VIG holds the first place for non-life insurance and the third place for life insurance.

Moldova

A total of 15 insurance companies are active in the Moldovan insurance market. In the 1st–3rd quarter of 2015, total premium increase of 1.0% in local currency in comparison with the previous year was reported. The market is dominated by the non-life business, which achieved premium increases of 0.6% in 2015, with a share of 93.6% of total premium volume. In life insurance, premiums grew in comparison with the previous year by 7.4%.

VIG is represented by the Group company Donaris in Moldova. Its acquisition last year enabled VIG to open up the last country in the CEE region and extend its presence to 25 countries. In Moldova VIG is third in the market with a share of 13.6%.

Serbia

In local currency, the premium volume reported growth of 18.0% in the 1st–3rd quarter 2015 in comparison with the same period of the previous year. The 17.1% increase in premiums in non-life insurance is mainly a result of positive performance in the area of motor third party liability insurance. The life insurance area in Serbia has only a low level of market penetration. Nevertheless, it was possible to increase premiums in the first three quarters of 2015 by 21.3%, with bank cooporations performing particularly well.

In Serbia, the Vienna Insurance Group is represented by Wiener Städtische Osiguranje in the field of life and non-life insurance. With market share of 9.3%, VIG is the fourth largest insurer. In life insurance, it is in the second place, and in non-life insurance, in the fifth place.

Turkey

The Turkish insurance market achieved a premium increase of 19.4% on a local-currency basis in the year 2015. With a share of 87.9% of total premium volume and a strong increase of 20.1% compared with the previous year, the non-life sector dominates the Turkish insurance market. The growth results both from the dynamic development of the property and casualty line of business (+17.6%) and from the sharp rise of 22.8% in motor insurance. Life insurance grew in 2015 by 14.7%.

VIG is represented by the non-life insurer Ray Sigorta in the Turkish insurance market. VIG’s 1.4% share of total premium volume places it in 13th place on the market.

Ukraine

Premiums in the Ukrainian insurance market grew by 27.1% in local currency during the 1st–3rd quarter of 2015. This resulted primarily from a 29.7% increase in non-life insurance. The non-life insurance market is strongly characterised by price fights and commission dumping. The devaluation of the currency and rate increases in the area of the motor third party liability insurance resulted in an increase of 22.7% in motor insurance, although a decrease in the number of new policies was observed. Gross premiums in the area of life insurance in the first three quarters of 2015 remained at the same level as in the same period of the previous year.

Vienna Insurance Group is represented in Ukraine by four insurance companies, the three non-life insurance companies UIG, Kniazha and Globus and the life insurance company Jupiter. VIG has a market share of 4.3%, which puts it in the third place in the Ukrainian insurance market. In the area of non-life insurance, Vienna Insurance Group is in the second place, and in life insurance, it is in the ninth place.

Hungary

The total premiums in the Hungarian insurance market in 2015 in local currency displayed growth of 2.5% in comparison with the previous year. The 8.3% increase in premiums in non-life insurance mainly results from positive performance in motor insurance. With regard to life insurance, in contrast, a decrease of 2.6% was reported, which results mainly from a decrease in single premium business. On the other hand, positive trends can be seen in the area of pension insurance. The tax advantages are having an effect and led to an increase in premiums of 58.8% during 2015.

VIG’s represented in Hungary by three companies: the life and non-Life insurance company Union Biztosító and the two life insurance companies Erste Biztosító and Vienna Life Biztosító. With a market share of 7.4%, VIG is in the sixth place in the Hungarian insurance market. In non-life insurance, VIG has a 5.9% market share and an 8.8% market share in life insurance, putting it in the 6th place for each.

Business development in the Remaining Markets in 2015

Premium development

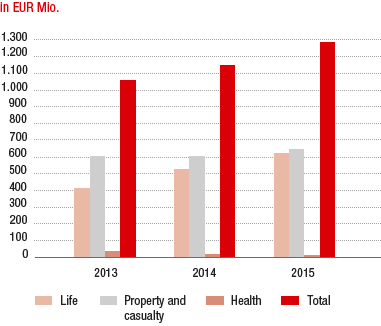

PREMIUMS WRITTEN IN THE REMAINING MARKETS

In the Remaining Markets, Vienna Insurance Group generated total premiums written of EUR 1,294.18 million in 2015 (2014: EUR 1,155.64 million), representing a significant increase of 12.0% compared with the previous year. Net earned premiums were EUR 981.70 million in 2015 (2014: EUR 880.13 million), an increase of 11.5% compared with the previous year.

Property and casualty insurance in the Remaining Markets increased premium volumes by 7.3% to EUR 650.44 million (2014: EUR 606.08 million). The countries in which development was particularly noteworthy are Turkey and Bulgaria which reported particularly dynamic growth rates in motor third party liability, motor own-damage, and fire insurance.

Life insurance premium income from Vienna Insurance Group companies in the Remaining Markets rose by 18.0% to EUR 626.95 million in 2015 (2014: EUR 531.42 million). In the CEE countries, the strong growth rates in the Baltic States, Bulgaria, and Hungary for regular premiums are particularly noteworthy.

In the area of health insurance, premiums written by the Georgian Group companies decreased by 7.5% to EUR 16.78 million. The decline is almost exclusively the result of the devaluation of the Georgian Lari.

Expenses for claims and insurance benefits

Expenses for claims and insurance benefits less re-insurance were EUR 697.28 million in 2015 (2014: EUR 653.14 million). In a comparison with the previous year, this means an increase in expenses for claims and insurance benefits (less reinsurance) of 6.8%, which resulted from the first-time consolidation of Vienna Life in Hungary (as of 1 July 2014) and of Donaris in Moldova (as of 31 December 2014).

Acquisition and administrative expenses

In 2015, acquisition and administrative expenses in the Remaining Markets of EUR 209.29 million in 2014 increased to EUR 215.45 million. This corresponds to an increase of 2.9% in comparison with the previous year, which above all results from the first inclusion of Vienna Life in Hungary (as of 1 July 2014) and Donaris in Moldova (as of 31 December 2014), as already mentioned.

Profit before taxes

Above all as a result of impairments on receivables in the area of property and casualty insurance in Bulgaria, profit before taxes in Remaining Markets decreased by 17.2% to EUR 42.79 million.

Combined ratio

In 2015, the VIG combined ratio in the Remaining Markets was 99.8% (2014: 97.6%). This is a result of higher loss ratios in the motor lines of business in Turkey and Albania.

in EUR million |

2015 |

2014 |

2013 |

Premiums written |

1,294.18 |

1,155.64 |

1,061.64 |

Life |

626.95 |

531.42 |

414.16 |

Property and casualty |

650.44 |

606.08 |

607.09 |

Health |

16.78 |

18.13 |

40.39 |

Profit before taxes |

42.79 |

51.66 |

49.00 |