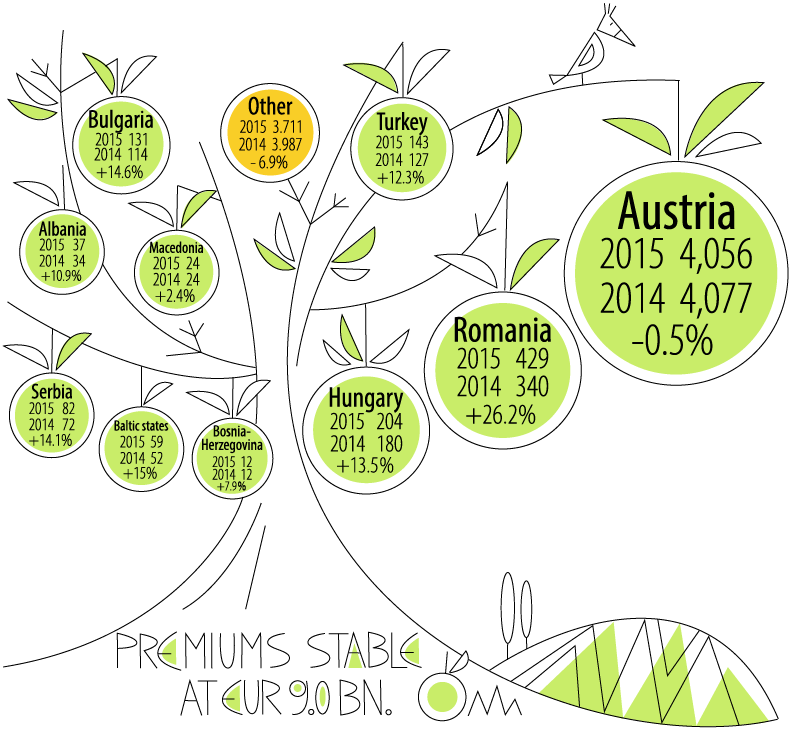

VIG expansion strategy bears fruit:

Bread and butter from Austria, sweet fruit from CEE

Premiums in EUR million rate of change in %

Other: Germany, Georgia, Croatia, Liechtenstein, Moldova, Poland, Slovakia, Czech Republic, Ukraine – Excluding Central Functions and consolidation

What is the best thing about our hard work? When the local companies bloom and prosper. Selected measures and achievements in 2015.

Austria

Wiener Städtische digital offensive. Wiener Städtische focused clearly on online capability and digital fitness in 2015 in order to proactively use the Technical Revolution in the interests of its customers. In addition to introducing a professional video advisory service, completely renewing its range of apps and redesigning its website, it also significantly expanded the opportunities for purchasing insurance online. Learn more about the Wiener Städtische digital offensive on page 19.

Repositioning of Donau Versicherung. Donau Versicherung has been part of Vienna Insurance Group since 1971. It is the sixth largest insurance company in the Austrian insurance market, making it one of the top players. The goal in 2015 was to set this long-established company on a new, updated course to ensure that it remained competitive and profitable for the long term. As part of this repositioning, a project was created to sharpen the profile of the company and a future strategic orientation was introduced. Donau Versicherung continues to follow its vision of being perceived as the most customer-oriented insurance company in Austria. In addition to a new mission statement, the newly defined values of awareness, drive, clarity and reliability form the basis for future company decisions.

1st place in the Recommender Award. s Versicherung receives an award for the fourth time in a row.

Recommender Award for s Versicherung. s Versicherung, Austria’s leading provider of life insurance, was awarded first place in the “Bank Insurance” category of the coveted Recommender Award, making this the fourth time it has received this special hallmark of excellence. A total of 8,000 customers of Austrian banks, insurance companies and home loan savings associations were surveyed for the award.

Czech Republic

Kooperativa is a “millionaire”! Kooperativa, number two in the Czech insurance market, issued its millionth property and casualty policy in 2015. This was a happy day for Martin Diviš, General Manager of Kooperativa: “It makes me very proud that we have reached this impressive figure. My thanks to all customers and employees who made this possible.”

Crowning of the Czech companies. The Golden Crown is awarded to the best insurance companies in the Czech Republic, and our companies were delighted to receive more than one of the awards in 2015. Kooperativa received awards in the “Business Insurance” and “Non-Life” categories, and PČS was chosen as the best life insurance company in the country for the seventh time in a row.

Bronze in the “Czech 100 Best”. The “Czech 100 Best” recognises the best companies in the Czech Republic each year. After receiving fourth place in 2014, Kooperativa made the leap to the podium with third place in 2015. This makes Kooperativa the best financial company in the country.

Slovakia

PSLSP receives silver in the TREND competition. PSLSP’s consistently good performance was once again recognised with an award. PSLSP received the silver medal in the prestigious “TREND Top 2015” competition organised each year by the business magazine TREND. This is the fifth time the Slovakian life insurance company has been on the podium – three times for silver and twice for bronze.

Poland

Combined strength in Poland. The merger of the two Polish non-life insurance companies Compensa and Benefia at the end of October 2015 was an important prerequisite for further increasing customer-orientation and efficient development of the market. The merged company bears the name Compensa TU SA Vienna Insurance Group, and occupies fifth place in the non-life insurance market with a market share of around 5%.

Romania

New focus for the Romanian Group companies. The optimisation measures implemented in the last few years are having an effect in Romania. All three companies worked tirelessly in 2015 on strengthening sales, developing customer-friendly products and improving their market presence. Asirom, for example, began restructuring its distribution networks and focused on expanding cooperations with brokers. BČR Life developed new products, including a life insurance policy that combined serious illness, such as cancer, with secured loans. There is no other comparable product in the Romanian market. While Omniasig focused on repositioning its brand and image. This included unifying its market presence to increase stakeholder identification with the company.

Omniasig brand campaign. Call for a sustainable, considerate approach to the environment.

Omniasig starts a new brand campaign. Omniasig presented itself in 2015 as a strong, responsible company taking part in the sustainable development of the country. As part of its “Insurance with Value” campaign, the Romanian VIG company called for a more considerate approach to the environment, because a future worth living requires a sustainable here and now. A small amount is sent to Ivan Patzaichin’s organisation for each Omniasig policy sold. The famous Romanian canoeist is promoting sustainable development of the Danube delta region and became a popular brand ambassador for the Omniasig brand.

Well-deserved award: Asirom won the “Product of the Year” award for “Casuta Noastra”, a household insurance product.

Best non-life insurer and product of the year. Omniasig won the award for “Best Non-Life Insurer of the Year” at the now traditional Insurance Market Awards Gala in Bucharest, organised by the Romanian publisher XPRIMM. The award recognises the best insurance company for outstanding sustainable development in the non-life segment. In addition, Asirom won the “Product of the Year” award for “Casuta Noastra”, a household insurance product.

Remaining Markets

VIG strengthens its market presence in the Baltic region. Vienna Insurance Group successfully continued on its expansion course in 2015 with a focus on the Baltic region. VIG considerably strengthened its presence in the Baltic countries by acquiring the Lithuanian distribution company Compensa Life Distribution and Latvian non-life insurer Baltikums, and by establishing a new company, Compensa Non-Life, in Lithuania. A majority interest was also acquired of BTA Baltic in Latvia towards the end of the year. The acquisition took place subject to necessary official approvals. As a result, VIG is now one of the top three insurers in the Baltic non-life insurance market. The huge potential of the region, which recorded average economic growth of around 2% in 2015, was already apparent to VIG in 2008. VIG successfully entered Estonia at that time with its acquisition of Group company Compensa Life.

Increasing distribution in Bulgaria. Group company Bulstrad, which has been part of the Group since 2002, entered into a cooperation agreement with United Bulgarian Bank (UBB) in 2015. UBB is the third-largest Bulgarian retail bank, reaching around one million customers through its 200 branches and points of sale. This acquisition allowed the Group to diversify its portfolio in Bulgaria and increase its sales potential using its multi-channel strategy. Bulstrad also acquired 100% of the shares in the company UBB-AIG, which was formed as a banc assurance company for UBB in 2006. After receiving official approval at the beginning of 2016, the name of the company was changed to Insurance Company Nova Ins EAD (Nova).

VIG successful in Ukraine, despite the crisis. The situation in Ukraine continues to be extremely difficult for the people there and we can only hope that the situation calms down soon. VIG has almost no representation in Crimea and the conflict areas in eastern Ukraine. In spite of difficult conditions, local management continued to handle the situation there outstandingly in 2015, thereby proving the value of VIG’s principle of local entrepreneurship. The Ukrainian companies achieved strong premium growth of 31.4% in local currency terms in 2015. VIG’s market share of 4.3% puts it in third place in the Ukrainian market.

Successful first year in Moldova. VIG has been represented in the Republic of Moldova since 2014, when it entered the market and acquired Group company Donaris. This filled the final gap in VIG’s coverage of the CEE region. Donaris is number one in large customer business and motor vehicle comprehensive insurance in Moldova. “VIG’s market entry made the company a pioneer in the Moldovan market that is setting new standards and challenging competitors,” explained Dinu Gherasim, Chairman of the Managing Board. This statement underscores the company’s upward movement in market ranking from fifth to third place in just one year.

Sales campaign in Bosnia-Herzegovina. The Bosnian market has been dominated by non-life insurance for years, particularly the motor vehicle line of business. Wiener Osiguranje launched a sales campaign to expand its product portfolio and increase customer awareness of products in the life sector. The focus here was on employee training to provide high quality service that would put the company one step ahead of its many competitors in the Bosnian market. The results can already be seen after one year. Life insurance premium volume rose sharply by 54.8%, while the cancellation rate for life insurance products fell by half at the same time.

Central Functions

VIG is one of Austria’s top brands. During the annual reinsurance meeting in Baden-Baden, Germany, VIG received the XPRIMM Insurance Award for its long-term contribution in Central and Eastern Europe. “VIG has made a lasting mark on the local insurance industry in the last ten years and helped implement European standards in the markets,” stated the jury. VIG was also placed ninth in the “Austrian Brand Value Study 2015”, putting it for the first time in the Top 10 of the most valuable corporate brands in Austria.