Management principles

MAIN PRINCIPLES FOR ACHIEVING VIG’S GOALS

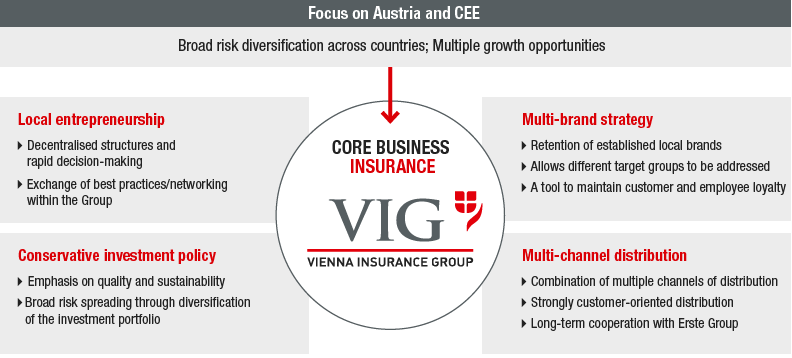

Successful multi-brand strategy

VIG’s multi-brand strategy is a valuable factor in setting it apart from its competitors. As part of its expansion strategy, the Group decided to retain well-established brands that already enjoyed good customer recognition. VIG therefore operates with multiple companies and brands in most of its markets. Thanks to different companies with different product portfolios, VIG succeeds in addressing various target groups. The Group companies use their local brand names as their first names, which strengthens their regional identity and creates a connection between local employees and the company. The “Vienna Insurance Group” addition is used as a last name, demonstrating international stature and many years of experience. This makes the customers feel more secure.

Use of this multi-brand strategy does not mean, however, that potential synergies are not exploited. Not only the use of resources is monitored regularly, but also the efficiency of the structures. In many countries, employees are already working successfully in cross-company back offices in order to perform administrative tasks more efficiently. Group companies may, however, be merged when the advantages of a diversified market presence are clearly outweighed by significant potential synergies. An example of this occurred in Poland in 2015.

Multi-channel distribution

In order to make the best possible use of its opportunities, VIG relies on a diversified distribution strategy in its markets. The objective is to win new customers through a wide range of channels. In addition to the Group’s own field sales staff, this is done through independent brokers and agents, multi-level marketing, direct sales, banks and digital media. The combination of the various distribution channels depends on the local market conditions. The aim is to meet the specific needs of people in the individual countries in the best possible way.

The relevance of a distribution channel for a specific market depends firstly on the legal framework, and secondly on the state of economic development of the insurance business. Distribution through banks has become more important in many markets in recent years. VIG recognised this trend early on and now benefits from a partnership with Erste Group, a leading banking group in Austria and the CEE region. VIG acquired all of Erste Group’s insurance activities in 2008 and entered into a long-term cooperation agreement with it. Under this agreement, Erste Group companies distribute VIG insurance products. In return, VIG companies offer their customers selected Erste Group banking products.

Conservative investment

The investment of customer funds entrusted to VIG in the form of premium payments is one of the key responsibilities of the Group. This task is associated with a particularly high level of responsibility. VIG therefore follows an investment strategy that is considered conservative. The content of this strategy is regulated by binding guidelines on investment for each VIG Group company. It is monitored on an ongoing basis firstly by Group Asset Management and secondly by the Internal Audit department. In addition to securing the necessary liquidity to guarantee insurance claims, particular emphasis is placed on diversification of the investment portfolio and achievable yields – taking into account the overall risk position.

At the end of 2015, Vienna Insurance Group was managing investments (including liquid funds) of EUR 31,812.46 million. Around 79.4% of these were fixed-interest securities and loans, 6.3% was allocated to real estate. Only 4.4% of total capital was invested in shares (including shares in the funds). (Details on the structure of investments can be found on page 36.) Thanks to this risk-conscious investment strategy, the investment structure has remained stable throughout the turbulence caused by the financial and economic crisis. It is nevertheless important to continuously examine and optimise the structure of the investment portfolio. In 2015, VIG retained its risk-conscious investment strategy and hardly made any changes. Therefore, investments in cash and fixed-term deposits, participations and corporate bonds increased slightly.

The conservative investment strategy plays a significant role, particularly taking into account the continuing low interest rates and ongoing obligations in the life insurance segment. These obligations will continue to be given the highest priority in the future with regard to investment. The life insurance companies in the Group are required to use appropriate control measures to ensure that this is the case. Internal analyses of maturity matching are performed regularly in the Group using current market parameters (yield curve).

Local entrepreneurship: “Think globally – act locally”

In addition to its multi-brand strategy and the benefits of using a variety of different distribution channels, VIG’s decentralised structure and rapid decision-making channels represent another special feature of the Company. The Company intentionally relies on the expertise of its local management and employees, who know the needs of the local population the best.

Instead of viewing the CEE region as homogeneous, VIG takes into account the structural differences and stages of development of the different insurance markets. This means that business models are not transferred from one country to another in an identical way. Products and distribution must instead be appropriate for the situation in each individual market. At the same time, the higher-level values and principles defined at the Group level need to be considered. Group-wide guidelines must in particular be observed in areas such as risk management, actuarial department, reinsurance and investment. In this process, the central holding company’s departments provide support to the VIG Group companies. In addition, they also ensure the continual further development and passing on of the higher-level Group guidelines. The exchange of best-practice solutions is made possible by means of regular cross-border meetings between management and employees. These meetings also promote a shared corporate culture.