Czech Republic

Czech insurance market

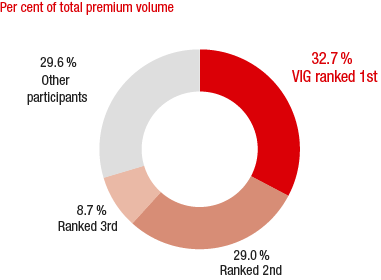

The Czech insurance market is dominated by two insurance groups, which together hold a share of over 60% of total premium volume.

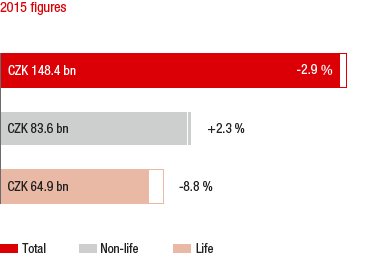

MARKET GROWTH IN 2015 COMPARED TO THE PREVIOUS YEAR

Source: Czech Insurance Association

In local currency terms, the Czech insurance market recorded a decline in premiums written of 2.9% in comparison with the previous year. This development is primarily the result of a major decrease (-26.7%) in single premium life insurance business. Life insurance with regular premiums was also down by 2.1%. The decrease results, among other things, from legislative and tax changes that have been in force since the start of 2015 and have a negative effect on the volume of contributions made by employers.

MARKET SHARES OF THE MAJOR INSURANCE GROUPS

Source: Czech Insurance Association; as of 2015

On the other hand, non-life insurance premiums rose by 2.3% in local currency terms in 2015. Irrespective of the fact that there is still severe price competition in the area of motor insurance, it was possible to achieve an increase of 3.6% in this segment. Premium income from motor third party liability insurance increased by 1.9%, with average premiums falling, however, as a result of the disproportionate increase in contracts acquired. Motor own-damage insurance benefited from good economic development, rising by 6.1%.

Insurance density in the Czech Republic totalled EUR 527 in 2014. Of this, EUR 282 was accounted for non-life insurance and EUR 245 for life insurance.

VIG companies in the Czech Republic

The Group is represented by three insurance companies in the Czech Republic. Next to Kooperativa and ČPP, the company PČS also belongs to the Vienna Insurance Group. In addition, since 2008, the Group’s own reinsurance company VIG Re has been operating in Prague, however this is allocated to the Central Functions.

The market share of Vienna Insurance Group in the Czech Republic for 2015 was 32.7%. This makes VIG the leading insurance group in the Czech market. In the area of life insurance, VIG is the leader, with a market share of 30.1%. The Group is in second place in non-life.

Business development in the Czech Republic in 2015

Premium development

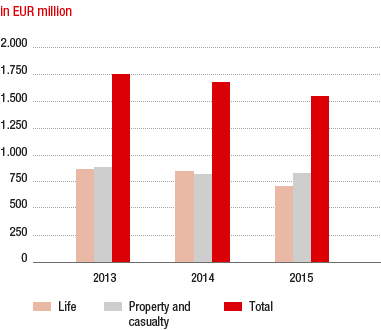

PREMIUMS WRITTEN IN THE CZECH REPUBLIC

In 2015, the premium volume of the Czech insurance companies was EUR 1,554.82 million. (2014: EUR 1,683.41 million), a decrease of 7.6% on the previous year’s level. Net earned premiums were EUR 1,204.78 million in 2015 (2014: EUR 1,366.04 million).

In property and casualty insurance, an increase in premiums of 1.4% to EUR 838.15 million was recorded (2014: EUR 826.65 million).

As a result of the restrained in single premium business, the written premiums fell by 16.3% to EUR 716.67 million

Expenses for claims and insurance benefits

The Czech companies had expenses for claims and insurance benefits (less reinsurance) of EUR 817.14 million in

2015, or EUR 140.38 million less than in 2014. This corresponds to a reduction of 14.7% which is attributable to the lower allocations to the actuarial reserve as a result of the decline in single premium business in life insurance. In addition, in property and casualty insurance, it was possible to decrease the loss ratios in the area of motor third party liability insurance significantly.

Acquisition and administrative expenses

The acquisition and administrative expenses were reduced by the Czech companies in 2015 by 4.9% to EUR 316.28 million. In 2014, the acquisition and administrative expenses still totalled EUR 332.47 million. The main reason for the improvement is the lower loss ratio in the area of motor third party liability insurance mentioned above. Through that the Czech Group companies received significantly higher reinsurance commission.

Profit before taxes

In 2015, the Czech companies contributed EUR 162.99 million to the total profit (2014: EUR 177.87 million). A significant factor in this decline of 8.4% was the declining financial result.

Combined ratio

The combined ratio remained at an excellent level of 90.7% in 2015 (2014: 86.2%).

in EUR million |

2015 |

2014 |

2013 |

Premiums written |

1,554.82 |

1,683.41 |

1,762.08 |

Life |

716.67 |

856.75 |

870.13 |

Property and casualty |

838.15 |

826.65 |

891.95 |

Profit before taxes |

162.99 |

177.87 |

197.82 |