Poland

Polish insurance market

The Polish insurance market is one of the largest in Central and Eastern Europe. The top 5 insurance groups generated a total of around 70% of the total premium volume.

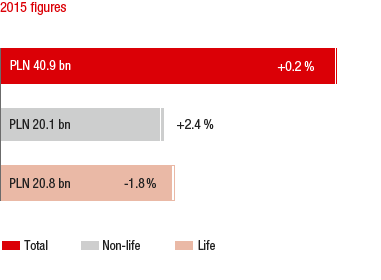

MARKET GROWTH IN THE 1ST TO 3RD QUARTER OF 2015 COMPARED TO THE PREVIOUS YEAR

Source: Financial Market Authority Poland

In the 1st–3rd quarter of 2015, the premiums written in the Polish insurance market increased based on local currency slightly by 0.2%.

In the area of non-life insurance, in the 1st–3rd quarter of 2015, premium growth of 2.4% was recorded. This was mainly due to an increase in premiums in the non-motor lines of business of 4.2%. The motor lines of business were able to achieve a slight premium growth of 0.7% in the 1st–3rd quarter of 2015, however they were still affected by intense competition with regard to price. This price pressure affected the motor third party liability insurance and resulted in a decrease in premiums of 0.7%. The motor own-damage insurance, on the other hand, increased by 2.8% in comparison with the same period of the previous year.

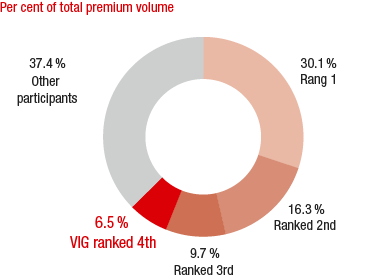

MARKET SHARES OF THE MAJOR INSURANCE GROUPS

Source: Financial Market Authority Poland; as of 9M 2015

In the area of life insurance, premiums written fell slightly in comparison with the previous year by 1.8%. The reason for this was the 5.0% decline in single premium products. Life insurance with regular premiums on the other hand developed in a stable manner, increasing by 0.6%.

Average per capita expenditure for insurance in Poland was EUR 341 in 2014. Of this, EUR 163 was accounted for non-life insurance and EUR 178 for life insurance.

VIG companies in Poland

Vienna Insurance Group is represented in the Polish market by five Group companies: Compensa Life and Non-Life, InterRisk, and the two life insurance companies Polisa and Skandia.

At the end of October 2015, the two property and casulty insurance companies Compensa and Benefia were merged. The merged company operates under the name Compensa Towarzystwo Ubezpieczeń SA Vienna Insurance Group.

Vienna Insurance Group’s market share was 6.5% for the 1st–3rd quarter of 2015. The Group holds fourth place in the Polish insurance market. In the non-life area, the Group is also in the top four. In life insurance, VIG is sixth in the market.

Business development in Poland in 2015

Premium development

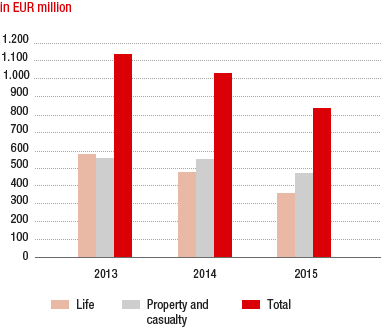

PREMIUMS WRITTEN IN POLAND

Vienna Insurance Group generated total premiums written of EUR 838.86 million in Poland in 2015 (2014: EUR 1,034.05 million). This was a decrease of 18.9% compared with the previous year. Net earned premiums were EUR 716.26 million in 2015, 16.0% lower than in 2014.

The premiums written in property and casualty insurance decreased in comparison with the previous year by 14.3% and totalled EUR 474.49 million (2014: EUR 553.86 million). The reduction was due to intense price competition in the motor line of business.

In the area of life insurance as a result of the decrease in single premium products, a decrease in premiums written of 24.1% to EUR 364.37 million was recorded. Regular premiums in life insurance, on the other hand, achieved a significant increase of 33.8%, mainly resulting from the consolidation of Skandia Poland from the second half of 2014.

Expenses for claims and insurance benefits

Vienna Insurance Group had expenses for claims and insurance benefits (less reinsurance) of EUR 501.34 million in Poland in 2015 (2014: EUR 582.74 million). This was a decrease of EUR 81.40 million, or 14.0% in expenses for claims and insurance benefits (less reinsurance). This development was caused by the significantly lower single premium business in life insurance.

Acquisition and administrative expenses

In 2015, the Polish Group companies of Vienna Insurance Group were able to reduce acquisition and administrative expenses by 15.9% to EUR 218.95 million (2014: EUR 260.33 Million), which is due in part to lower commissions in the motor line of business, in which significantly lower premiums were achieved as a result of the intense price competition.

Profit before taxes

In 2015, the Polish companies recorded profit before taxes in the amount of EUR 43.40 million. The decrease of 21.3% can mainly be attributed to increased price competition in the motor insurance line of business in combination with the lower financial result due to the market conditions.

Combined ratio

In Poland, the combined ratio in 2015 was just below the 100% mark at 99.3% (2014: 96.3%) as a result of the increased price competition in the motor insurance line of business.

in EUR million |

2015 |

2014 |

2013 |

Premiums written |

838.86 |

1,034.05 |

1,142.30 |

Life |

364.37 |

480.19 |

582.23 |

Property and casualty |

474.49 |

553.86 |

560.07 |

Profit before taxes |

43.40 |

55.16 |

50.22 |