Strategic milestones and measures in 2015

In addition to the above principles determining the strategic course taken by the Group, the strategy of Vienna Insurance Group is given concrete form and implemented by means of a large number of projects and measures. A list of some of the projects and decisions that had a major effect in financial year 2015 is provided below:

Multi-brand strategy – continuation of expansion

VIG is consistently pursuing expansion in Central and Eastern Europe. In 2015, the Group’s activities focused on the Baltic States. In addition, the Group expanded its involvment in Bulgaria.

Formation of Compensa Non-Life in Lithuania

At the end of July 2015, VIG received a licence from the local authorities for the formation of Compensa Non-Life in Lithuania. VIG has been successfully distributing products in the non-life insurance through the Polish Group company Compensa Non-Life since 2010. The newly formed company will now take over the business of the Polish Compensa Non-Life company, thereby significantly strengthening Vienna Insurance Group activities in the Baltic insurance market.

Acquisition of the Latvian non-life insurer Baltikums

Vienna Insurance Group signed an agreement in July 2015 for the purchase of 100% of the shares of the company Baltikums AAS, Riga. In addition to its headquarters in Riga, Baltikums also operates through its branch in Lithuania. Receipt of official approval in October 2015 means that the transaction has now been concluded.

Acquisition of BTA Baltic in Latvia

At the end of 2015, VIG was able to reach an agreement on the acquisition of a majority share in BTA Baltic Insurance Company AAS (BTA Baltic), which, in addition to its headquarters in Latvia, also has branches in Lithuania and Estonia. The acquisition is subject to official approval. The conclusion of the transaction will mean that Vienna Insurance Group becomes a major player in the Baltic region in both life and non-life insurance.

Expansion in Bulgaria

The VIG Group company Bulstrad entered into an agreement for the acquisition of 100% of the shares in the company UBB-AIG. After receiving official approval in January 2016, the name of the company was changed to Insurance company Nova Ins EAD (Nova). With this move, the Company diversified its portfolio in Bulgaria and took advantage of the opportunity to tap into new customer segments. UBB-AIG was formed in 2006 as a bank-assurance company for United Bulgarian Bank (UBB). At the same time as the acquisition, a cooperation agreement was signed with UBB.

Multi-channel distribution – strengthening of the distribution network

Vienna Insurance Group relies on a diversified distribution strategy. In 2015, the Group strengthened its sales potential by expanding its distribution network in the Baltic States and Bulgaria, in order to ensure optimal access to customers.

Acquisition of a Lithuanian life insurance contribution company

VIG Group company Compensa Life has strengthened one of its key distribution channels in Lithuania with the acquisition of Finsaltas, a company that specialises in the distribution of life insurance. During the takeover, the distribution company’s name was changed to Compensa Life Distribution. With around 300 insurance brokers, Compensa Life Distribution is Lithuania’s largest life insurance distribution company.

VIG increases distribution opportunities in Bulgaria

At the same time as acquiring the Bulgarian insurer Nova, previously known as UBB AIG, the VIG Group company Bulstrad entered into a cooperation agreement with United Bulgarian Bank (UBB). This enabled the Group to strengthen its sales potential by means of its multichannel distribution strategy. UBB is the third largest retail bank in Bulgaria. Its network includes more than 200 branches and sales outlets. Through cooperation initiatives, VIG has ensured access to around one million customers of UBB.

Optimisation measures and initiatives

With regard to local entrepreneurship, each Group company is responsible independently for implementation of its strategy and profitability. In addition, Group-wide measures and initiatives exist.

Merger of the Polish property and casualty insurance companies Compensa and Benefia

Successful completion of the merger of the two property and casualty insurance companies Compensa and Benefia at the end of October 2015 strengthened VIG’s market presence in Poland. The merged company operates under the name Compensa TU SA Vienna Insurance Group.

Optimisation of the capital structure Bond issue and redemption

On 2 March 2015, the Company issued a subordinated bond with a total nominal value of EUR 400.0 million and a term of 31 years. The Company can call the bond in full for the first time on 2 March 2026 and on each following coupon date. The subordinated bond bears interest at a fixed rate of 3.75% p.a. during the first eleven years of its term and variable interest after that. The subordinate bond satisfies the Tier 2 requirements of Solvency II. The bond is listed on the Luxembourg Stock Exchange. In March 2015, EUR 51,983,000 of the nominal value of tranche 1 of the EUR 500 million in hybrid bond issued in 2008 was repurchased by the Company, as well as EUR 35,822,500 of the nominal value of the supplementary capital bond 2005–2022 issued in January 2005.

Strategic forward-looking SME initiative

As part of the growth strategy in the small and medium enterprises (SME) segment, it was also possible to implement the planned product and sales optimisation in a sustainable manner in 2015. The main focus here was on sales development, as well as the use of cross-selling potential for existing customers via a wide range of distribution channels. In addition, SME products were developed and modified, and the exchange of best practice activities within the Group was driven forward. This enabled the SME business to increase written premiums by around 6%, thereby achieving a total premium volume of approximately EUR 300 million within VIG during 2015.

Life Insurance – reduction in single premiums

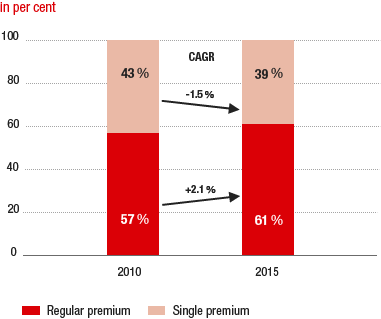

COMPOSITION OF LIFE INSURANCE IN FIVE YEAR COMPARISON

The strategic decline in traditional single premium business in the area of life insurance progressed consistently in financial year 2015. It was possible to reduce the share of life insurance written premiums accounted for by single premiums by around 39% in 2015. The reason for the deliberate reduction is firstly the continuing low interest rate level, and secondly income issues mainly in the core markets of Poland and Slovakia. The reduction is taking place in these two countries primarily in the short-term single premium sector.

Property and casualty insurance – acceleration of property insurance

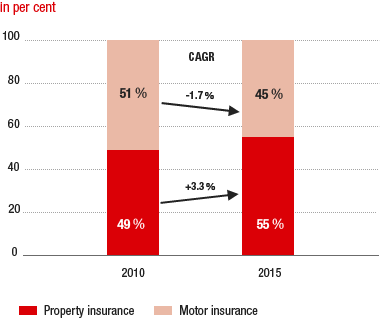

COMPOSITION OF PROPERTY AND CASUALTY INSURANCE IN FIVE YEAR COMPARISON

Motor insurance is characterised by strong competition and decreasing average premiums in many Central and Eastern European countries. Vienna Insurance Group is pursuing healthy, high-income growth. The aim is therefore to reduce premium volume in the area of motor insurance in countries that are dominated by strong price competition. Instead, advantage is being taken of the potential in the area of property insurance. Customers are being made aware of these insurance products by means of targeted sales campaigns. During 2015, an increase of 0.8% was achieved in the area of property and casualty insurance. As a result the share of motor insurance fell to around 45%.

Solvency II – approval of the partial internal model

As of 1 January 2016, the new insurance supervision system, Solvency II, came into force at the European level. The requirements for capital resources, risk management, and the associated reporting obligations were increased. The calculation of the equity requirement in accordance with Solvency II can be performed in compliance with a standard model prescribed by supervisory law or based on an individually developed internal model. In order to model the Company’s own risk profile in a manner that most closely reflects the actual state of affairs, VIG developed a partial internal capital model. The financial markets supervisory authority approved it in December 2015. This made VIG the only Austrian insurance group which will have supervisory authority approval for use of a model right from the start. In accordance with this internal model, the solvability (equity ratio) at the level of the listed Group is in the order of around 200%.