Andreas Treichl, CEO of Erste Group, on the effects of the historically low interest rates:

Good intentions, but not good

We are living in a period of almost zero interest rates that creates happy borrowers and angry savers. As shown in our interview with Andreas Treichl, however, it also poses risks for business activity and substantial risks for the economic system.

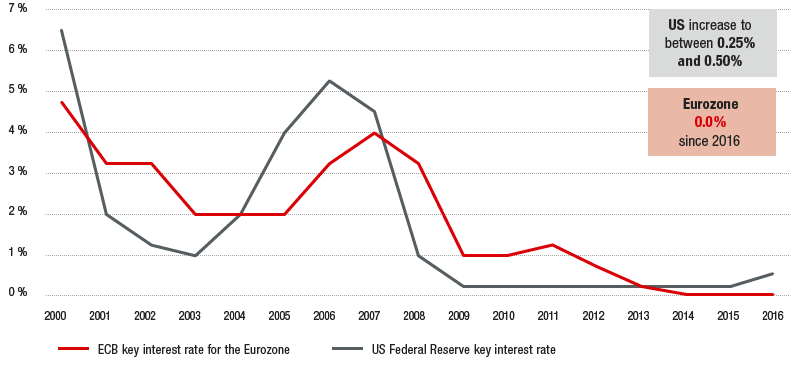

The ECB lowered its key interest rate to 0.0% for the first time in March 2016. It was previously reduced to 0.05% in September 2014. What effects does this have on the financial sector?

Very dramatic effects. It is not the low interest rate policy alone, but the length of time it has been in force that is causing major changes to our entire economic system. I am not talking about bank profitability, which is suffering seriously as a result. The problem is that the risks in the economy are no longer being priced properly. The ECB has also created capital market expectations that are almost impossible to fulfil. I would never have thought the European Central Bank would actually implement the canonical prohibition on interest. The long-term effects, however, are what I consider to be even more dramatic. Think, for example, about pension funds. It is very difficult for them to achieve the increase in private pension fund assets that form the basis of the system. The compound interest effect has practically been eliminated for private capital formation. We are laying the foundation for old-age poverty with dramatic consequences. Making it impossible for people to earn interest on savings would destroy the middle class. Although we have previously seen negative real interest rates, even in years of high inflation, zero interest rates are much more emotionally depressing for savers.

In your view, did this achieve the intended goal of stimulating the economy?

In general, I would not say this is true. In any case, the economic data do not show such an effect everywhere. The measures certainly did reduce funding costs for the business sector and lead to a weakening of the euro. This should, in theory, give a boost to economic recovery in the Eurozone, in which Austria is lagging alarmingly behind in terms of economic growth. Companies are very reluctant to make investments. There is a lack of confidence and stable conditions, for example in the area of taxation. And we see once again that low lending rates alone are not sufficient to drive the economy.

To what extent do you think the increased regulation of lending works against this goal?

Increased equity requirements are aimed at making the banking sector more secure in the long run, and this is a good objective overall. One of the problems is uncoordinated multiple burdens placed on banks, such as the bank levy and various EU funds. Another is that the increased regulation of the financial sector makes it almost impossible for banks to take on risks from the business sector. This makes it more difficult to stimulate an economic revival. What we need now is five years without new regulations every month. We need time, as does the business sector, to implement existing rules and to see what their effects are.

Quantitative easing in the form of bond purchases is one of the key elements in the ECB’s expansive monetary policy. Can you explain the intended effects on the economy and inflation?

The ECB is buying bonds from other investors in the secondary market so that these investors will, in turn, make “riskier” investments. This gives banks more funds for lending, but the end result also naturally depends on the demand for loans. In some Eurozone countries e.g. Italy and Spain, these measures have actually been successful in helping to reduce the cost of funding for businesses. But the most important result of the bond purchases was the weakening of the euro compared to other currencies, thereby increasing exports. This boost in economic activity should, in turn, have a positive effect on inflation. However, the sharp drop in the price of oil and commodities is currently depressing inflation and the ECB still remains a considerable way off its goal.

The US Federal Reserve raised its key interest rate to a range of 0.25% to 0.50% in December 2015 – can this actually be described as an interest rate turnaround?

The step taken by the Federal Reserve is too modest for this description. I would not talk about a sustainable turnaround until we are back above 1% again.

When and under what conditions do you expect a similar reversal of monetary policy in the Eurozone?

That is a good question, and it is hard to answer. The USA is significantly ahead of the Eurozone in the economic cycle. Just look at the developments that took place in the first few weeks of this year. The growth slowdown in China and other emerging markets together with low commodity prices mean that the ECB will maintain its current policy for even longer.

To what extent is the European economy benefiting from the depreciation of the euro compared to the US dollar?

In theory, a weaker euro should help our export sector. In Austria, export is currently the only relevant growth-supporting area. Even the modest GDP growth that was recorded would not have occurred without this increase in exports. But we should not fool ourselves into thinking that the weakness of the euro is only due to the difference between interest rates in the Eurozone and the USA. It is also a reflection of our weaker economic output, a lack of growth momentum and insufficient propensity to invest. If we as the EU want to play in the same league as the USA, we have to do more to actually function as a large internal market with an appropriate level of internal demand. This requires not only a banking union, but also a clear common presence as a political union. No one from Washington to Beijing will take us seriously as a group of 28 egocentric nation states pursuing individual interests.

EUR and USD key interest rates since 2000

ERSTE GROUP AND VIG COOPERATION

The two large CEE groups, Vienna Insurance Group and Erste Group, formed a strategic partnership in 2008. VIG acquired Erste Group’s insurance operations, and VIG has been selling its products through its sales partner Erste Group since that time. In return, VIG companies offer Erste Group’s banking products, creating a win-win situation for both Groups.