CEE region: Potential waiting to be used

Further growth to come

Vienna Insurance Group has insured Central and Eastern Europe for 25 years. The region offers above-average growth and huge market potential, and therefore plays an integral role in the success of the Group.

Euphoria was high in the East and West in 1989 and 1990, as the former communist governments in Central and Eastern Europe were removed from power by their own people. What had previously been considered impossible had happened. The Iron Curtain had fallen.

It was above all Austrian companies that recognised the opportunity presented by this change and found the courage to invest in these new markets. As a result, Austria quickly became the most important investor in this emerging region. Wiener Städtische was right in the middle of this movement, and its successful expansion in following years led to creation of the internationally operating Vienna Insurance Group.

The expansion reached its high point in the mid-2000s. The Group obtained the capital it needed to continue its expansion in the CEE region by performing the largest capital increase ever undertaken by an Austrian insurance company.

Maintaining its strategy. The financial and economic crisis that originated from the USA in 2007 nevertheless dampened the feeling of euphoria that existed in the first few years. Many analysts, economists and rating agencies predicted a dismal future, including for Austria, which was now closely tied to the region due to its investments. They believed that these ties to CEE markets, particularly in the finance and banking sectors, would drag Austria into the abyss. As a result, many concluded that Austrian companies should make an orderly withdrawal from their investments in the east.

This was, however, never in question for VIG, which was firmly anchored in the CEE region. It maintained its strategy, despite prophesies of doom, and the facts and figures show it was right. While the economy of Western Europe continues its deep sleep, the CEE region is recording an upswing.

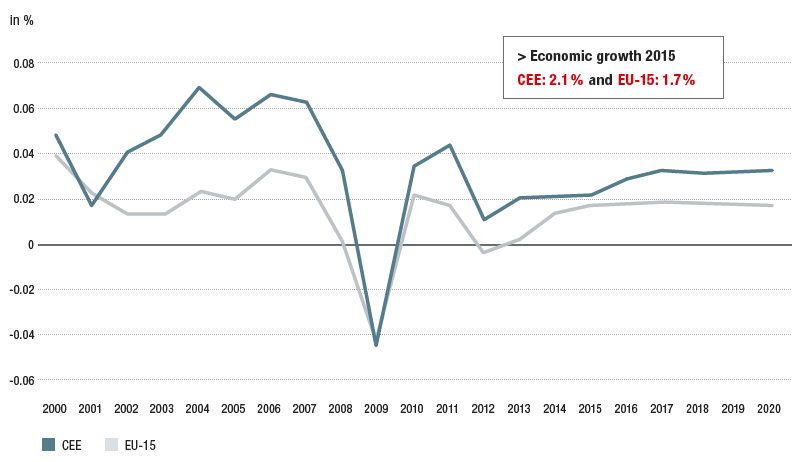

The CEE region is one step ahead. A considerable gap has opened up again between the East and West, but this time in the other direction. The economies of Central and Eastern Europe grew considerably faster in 2015 than that of Austria. This trend is set to continue and intensify. The countries from Poland to Romania are particularly noteworthy for their high growth rates, rising employment and current account surpluses. According to estimates by the International Monetary Fund, growth in the CEE region will be 1.2 percentage points higher than Austria in 2016. By 2020, this gap will actually increase to 2.2 percentage points. The Polish economy grew by 3.5% in 2015, and that of Slovenia by 2.3%. These are increases that the western part of the continent can only dream of. Italy and Austria achieved 0.8% and even Germany only managed to grow by 1.5%.

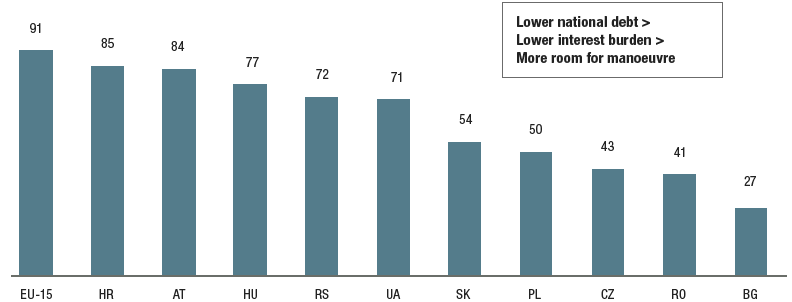

The CEE countries also have another major advantage compared to Western countries, namely a comparatively low level of national debt, which gives them considerably more room for manoeuvre. The CEE region continues to be the engine of growth for Austria, particularly for companies with strong local ties.

Growth potential at multiple levels. For Vienna Insurance Group this brave strategic decision has paid off. With a market share of more than 18% in its core markets, it is a clear market leader. Around half of all premiums and significantly more than 50% of the profit now come from the CEE region.

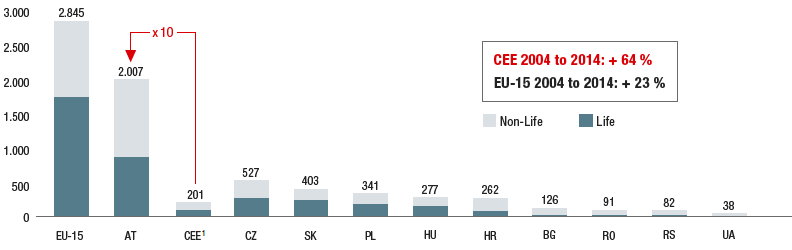

The economic momentum of the CEE region and positive growth prospects of companies investing there open up enormous opportunities. Using the insurance industry as an example, it can be shown that density in the CEE region as measured by per capita expenditure on insurance is around one tenth of the Austrian level. It should also be added that even Austria has only reached approximately 70% of the level in the “old” EU-15 countries. As prosperity increases, the demand for insurance also rises – and that in a region with 180 million potential customers.

The CEE strategy that has been adopted therefore creates huge growth potential for VIG. And this potential is based on an exceptionally sound starting position. The Group now operates around 50 companies in 25 countries. It is not focused on the “usual suspects” in the region, namely Poland, the Czech Republic, Slovakia and Hungary, but is now present throughout the region. Entry into Moldova in 2014 filled the final gap in coverage of the CEE region.

Risk diversification. This generates major benefits in terms of risk diversification. If some markets do not perform that well, they are compensated by other, faster growing countries. Within VIG, this logic is further reinforced by a growth phases model, which is based on the fact that faster and slower phases alternate in the individual countries. All distribution channels are used at full strength during growth phases, while the focus is on high-margin business areas and cost control during quiet phases.

If the economic researchers’ predictions are correct, however, it appears that we – Vienna Insurance Group – will be dealing with a great deal more “growth” than “quiet” phases in the next few years. This is no surprise. The CEE has regained its momentum, and companies that never lost their belief in the region are the ones that will benefit the most.

Development of insurance density EU-15 and CEE region

Per capita expenditure on Insurance in EUR

Source: CEE: In-house calculations based on data published by national insurance supervisory authorities and associations, the IMF and Swiss Re;

1 Weighted average: Bulgaria, Croatia, Poland, Romania, Serbia, Slovakia, Czech Republic, Ukraine, Hungary;

Source EU-15: Swiss Re (Sigma)

Forecast of economic growth in the CEE region vs . EU-15

in %

Source: IMF

Comparison of national debt in the EU-15 and VIG core markets

% of GDP (2014)

Source: IMF, Eurostat (EU-15)