Key figures at a glance

|

|

2016 |

2015 adjusted |

2014 adjusted |

||||||

|

||||||||||

Income statement |

|

|

|

|

||||||

Premiums written |

EUR millions |

9,050.97 |

9,019.76 |

9,145.73 |

||||||

Net earned premiums – retention |

EUR millions |

8,191.26 |

8,180.54 |

8,353.74 |

||||||

Financial result |

EUR millions |

958.81 |

1,040.20 |

1,076.48 |

||||||

Expenses for claims and insurance benefits |

EUR millions |

-6,753.45 |

-6,748.87 |

-6,919.93 |

||||||

Acquisition and administrative expenses |

EUR millions |

-1,907.81 |

-1,847.57 |

-1,874.77 |

||||||

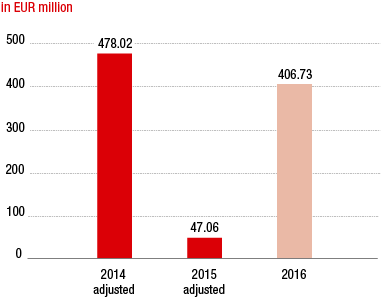

Result before taxes |

EUR millions |

406.73 |

47.06 |

478.02 |

||||||

Net result for the period after taxes and non-controlling interest |

EUR millions |

287.78 |

-20.58 |

330.42 |

||||||

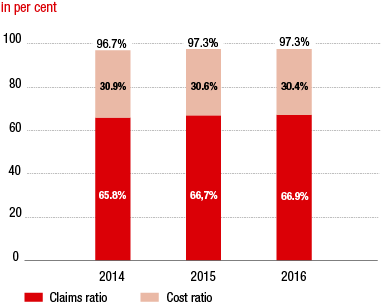

Combined Ratio |

% |

97.3 |

97.3 |

96.7 |

||||||

Claims ratio |

% |

66.9 |

66.7 |

65.8 |

||||||

Cost ratio |

% |

30.4 |

30.6 |

30.9 |

||||||

Balance sheet |

|

|

|

|

||||||

Investments1 |

EUR millions |

43,195.84 |

38,286.10 |

38,002.20 |

||||||

Shareholders’ equity (excluding non-controlling interests) |

EUR millions |

5,711.26 |

4,414.46 |

4,796.33 |

||||||

Underwriting provisions |

EUR millions |

37,349.96 |

35,921.73 |

35,282.37 |

||||||

Total assets |

EUR millions |

50,008.11 |

44,489.71 |

43,923.13 |

||||||

RoE (Return on Equity) |

% |

8.9 |

1.1 |

11.1 |

||||||

Share |

|

|

|

|

||||||

Number of shares |

Piece |

128,000,000 |

128,000,000 |

128,000,000 |

||||||

Market capitalisation |

EUR millions |

2,726.40 |

3,237.12 |

4,746.24 |

||||||

Average number of shares traded by day |

Piece |

~ 161,000 |

~ 147,000 |

~ 65,000 |

||||||

Average daily stock exchange trading volume (single counting) |

EUR millions |

3.90 |

6.80 |

3.10 |

||||||

Year-end price |

EUR |

21.300 |

25.290 |

37.080 |

||||||

High |

EUR |

24.790 |

42.620 |

40.070 |

||||||

Low |

EUR |

16.095 |

24.910 |

33.800 |

||||||

Share performance for the year (excluding dividends) |

% |

-15.80 |

-31.80 |

2.36 |

||||||

Dividend per share |

EUR |

0.802 |

0.60 |

1.40 |

||||||

Dividend yield |

% |

3.76 |

2.37 |

3.78 |

||||||

Earnings per share |

EUR |

2.16 |

-0.27 |

2.46 |

||||||

Price-earnings ratio as of 31 December |

|

9.86 |

-93.67 |

15.07 |

||||||

Employees |

|

|

|

|

||||||

Number of employees (average for the year) |

|

24,601 |

22,995 |

23,360 |

||||||

CHANGE IN PROFIT

CHANGE IN THE COMBINED RATIO

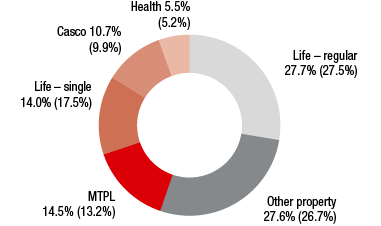

PREMIUMS BY LINES OF BUSINESS

Values for 2015 in parentheses

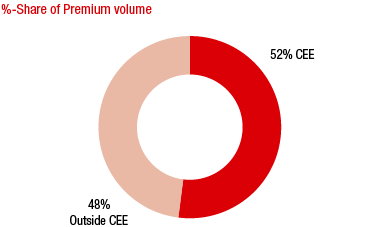

CEE SHARE OF PREMIUM VOLUME