VIG accelerates its health insurance offer

This line of business has particularly high potential in Central and Eastern Europe.

A combination of rising healthcare costs, ageing populations and technical progress in medicine are causing government systems to reach their limits. As a result, private health coverage is becoming significantly more important, which is one of the reasons Vienna Insurance Group is also focusing on expanding this line of business.

Health insurance currently represents only a small portion of the total premiums of the Group. This will, however, change in the future, due to increasing demand for solid health coverage from the growing middle class in the CEE region. In this region, private insurance is especially a future market where the government system fails to provide full coverage.

This issue has been given increased attention at Vienna Insurance Group for around a year. We are currently analysing markets where products can be introduced to supplement government programmes. The markets in Bulgaria, Hungary, Romania, Poland and Turkey were already identified as offering the greatest opportunities. As a result, country-specific development programmes are now being implemented, and regional product solutions are also being examined.

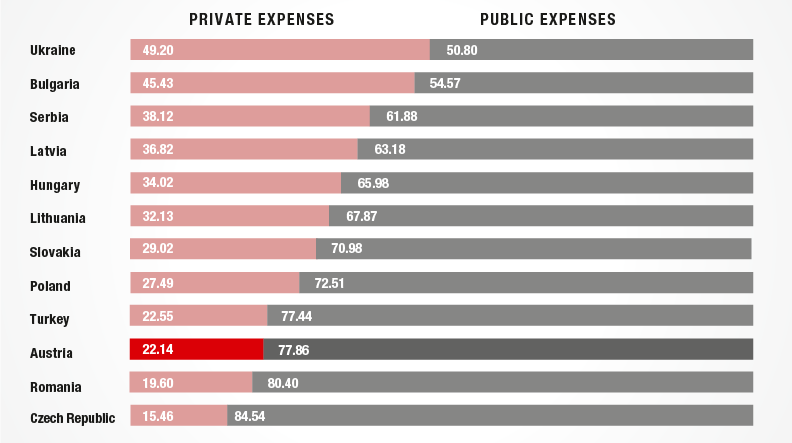

An important result of the analyses is that healthcare expenditure depends on a number of social and economic factors. These include the level of income in a country, the quality of the coverage offered by the public sector and the population’s expenditure on private healthcare. As shown by the chart, the share of private healthcare expenditure to total expenditure varies greatly from country to country. And also the acceptance of private health insurance solutions: While around one third of the population now has private supplementary coverage in Austria, the percentage in Central and Eastern European countries is still very low, even though a highly significant portion of healthcare expenditure is privately funded in some countries.

This situation and the change in awareness of optimal coverage indicate a large amount of growth potential. The fact that premiums in the CEE region rose by 20% in 2016 shows that the path VIG has chosen is the right one. In addition, the public sector is increasingly prepared to provide tax subsidies for private health insurance and integrate them into the state insurance system.

The current situation differs greatly in some of Vienna Insurance Group’s markets. While Turkey has a comparatively well-established market for private insurance, in Romania it is still very small. In Poland, demand for private health insurance is growing significantly. Demand is particularly high for products covering outpatient treatment and diagnosis in private-sector medical centres.

In Hungary, private health insurance is primarily offered in the form of group health insurance. This is due to the tax advantages offered for companies. This market has grown considerably in recent years.

Private coverage for health risks is an attractive future market in the Central and Eastern European region. The level of market saturation is still low given the increasing prosperity. Vienna Insurance Group aims to take advantage of this potential.

HEALTH EXPENSES (% TOTAL)

Source: WHO Global Health Expenditure Database, 2014