Poland

Polish insurance market

The Polish insurance market is one of the largest in Central and Eastern Europe. The top 5 insurance groups generated around 70% of the total premium volume.

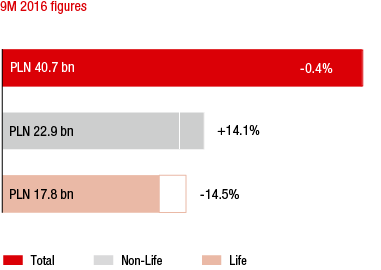

MARKET GROWTH IN THE 1st to 3rd quarters of 2016 COMPARED TO THE PREVIOUS YEAR

Source: Financial Market Authority Poland

The Polish insurance market recorded a slight drop of 0.4% in local currency terms during the first three quarters of 2016. Even though premium volume rose 14.1% in the non-life area, this was not enough to offset the change in life insurance, which fell 14.5%, mainly due to a decrease in single-premium business (-34.1%). Premiums from regular premium products, which, at close to 70%, represent the largest share of the life segment, also recorded a decrease of 1.0% in local currency terms. The negative trend in life insurance is the result of regulatory changes that increase the information requirements for investment products. These information requirements, however, also had the effect of reducing early policy cancellations.

The motor lines of business made particularly large contributions to the strong growth in non-life insurance. Motor third party liability increased 32.4% in local currency terms and motor own damage insurance rose 18.5%. Premiums in the non-motor lines of business rose moderately by 1.5% in the first nine months of 2016.

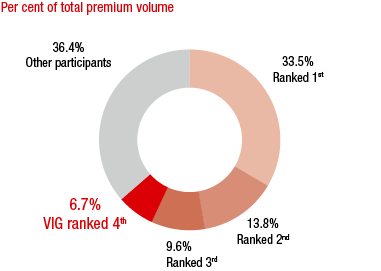

MARKET SHARES OF THE MAJOR INSURANCE GROUPS

Source: Financial Market Authority Poland; as of 9M 2016

Poland had an insurance density of EUR 345 in 2015. EUR 172 of this amount was for non-life insurance and EUR 173 for life insurance.

VIG companies in Poland

VIG is represented by five Group companies in Poland: Compensa Life and Non-Life, InterRisk, and the two life insurance companies Polisa and Vienna Life. The name of the last of these companies was changed from Skandia to Vienna Life in October of the current year during integration into the Group.

VIG’s market share of 6.7% in the 1st to 3rd quarters of 2016 puts it in fourth place in the Polish insurance market. The Group is in fifth place in the non-life area, and the Polish VIG companies hold fourth place in the life insurance market.

Business development in Poland in 2016

Premium development

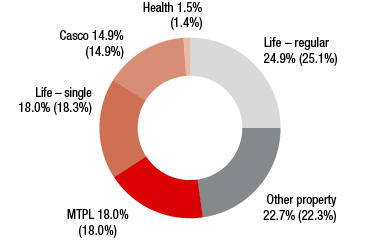

PREMIUMS WRITTEN BY LINE OF BUSINESS

Values for 2015 in parentheses

Vienna Insurance Group generated total premiums written of EUR 819.18 million in Poland in 2016 (2015: EUR 838.86 million), representing a decrease of 2.3% compared to the previous year. When adjusted for transfer of the Baltic non-life business and negative exchange rate effects, on the other hand, significant growth of 5.1% was achieved. Net earned premiums were EUR 669.70 million in 2016, 6.5% lower than in 2015.

Expenses for claims and insurance benefits

The Polish Vienna Insurance Group companies had expenses for claims and insurance benefits (less reinsurance) of EUR 542.65 million in 2016 (2015: EUR 501.34 million). This was an increase of EUR 41.31 million or 8.2% in expenses for claims and insurance benefits (less reinsurance). This change was primarily due to changes in the cancellation terms when certain life insurance products are surrendered.

Acquisition and administrative expenses

The Polish VIG companies reduced acquisition and administrative expenses by 27.6% to EUR 158.45 million in 2016 (2015: EUR 218.95 million). This was primarily the result of a reduction in commission expenses due to a significant drop in premiums in the high commission area of term life insurance.

Profit before taxes

The Polish companies earned profit before taxes of EUR 1.88 million in 2016 (2015: EUR 20.83 million). The decrease primarily resulted from a reduction in the financial result due to difficult market conditions, intense price competition, especially in the motor area, the newly introduced investment tax and the change in cancellation terms mentioned above.

Combined ratio

In spite of difficult market conditions, the combined ratio remained at the level of the previous year in 2016 at 99.4% (2015: 99.3%).

in EUR million |

2016 |

2015 |

2014 |

Premiums written |

819.18 |

838.86 |

1,034.05 |

Motor own damage insurance |

122.30 |

125.30 |

140.85 |

Motor third party liability insurance |

147.57 |

150.82 |

177.89 |

Other property and casualty insurance |

185.48 |

186.81 |

221.26 |

Life insurance – regular premium |

204.17 |

210.91 |

157.62 |

Life insurance – single-premium |

147.05 |

153.46 |

322.57 |

Health insurance |

12.60 |

11.57 |

13.86 |

Result before taxes |

1.88 |

20.83 |

53.40 |