“We still have a great deal of upward potential”

There are two things you absolutely need as a pioneer: a lot of courage and patience. After the fall of the Iron Curtain, many Austrian companies showed they were up to the challenge and invested offensively in the new market of Central and Eastern Europe. Four of them explain why they still believe they made the right decision and what their plans are for the future.

The Ringturm building in Vienna is more than Austria’s first office highrise. When it opened in 1955, the Vienna Insurance Group’s headquarters was a symbol of the country’s return to freedom and the start of an economic upturn. The situation was completely different, however, just a few kilometres to the east. Europe was divided, and the eastern part of the continent dominated planned economies and unfreedom.

The fact that Austria was cut off for decades from the economy in Central and Eastern Europe is no longer apparent in the Ringturm. Quite the opposite. When you enter the lobby of the headquarters nowadays, you are immediately surrounded by the variety of Central Europe. German, Croatian, Czech, Romanian – a different language is spoken around every corner.

Central and eastern europe – A growth market

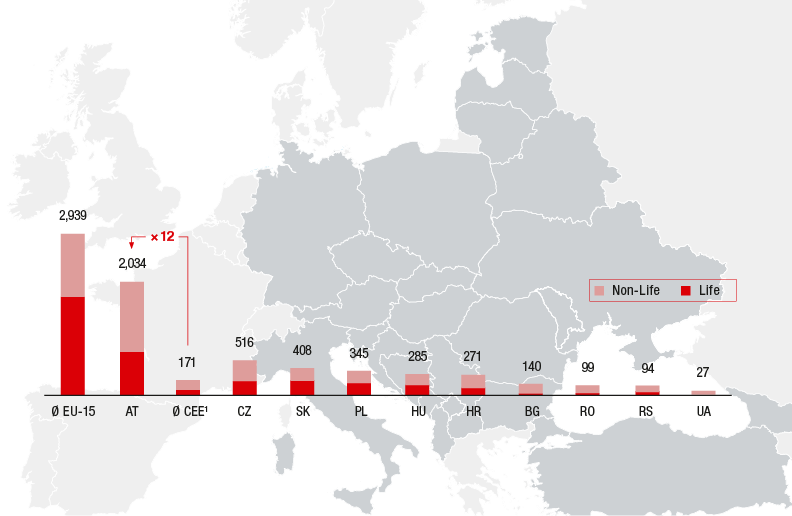

Per capita insurance premiums in euros.

The countries of Central and Eastern Europe have a great deal of catch-up potential with regard to insurance coverage and protecting their increasing level of prosperity. CEE insurance markets are still far from being saturated, and growth rates are significantly higher than in Western European countries.

Source: in-house calculations based on data published by national insurance authorities and associations, the IMF and Swiss Re (Sigma);

1 weighted average of all VIG CEE markets, 2015

Convergence of prosperity brings growth

Elisabeth Stadler, CEO of VIG

Per capita insurance expenditure in the CEE market is only around one twelfth of the level in Austria.

When the Iron Curtain fell at the beginning of the 1990s, many Austrian companies seized the opportunity and invested intensively in the CEE region. “Austrian banks in this form would no longer exist if the expansion into neighbouring countries had not taken place,” said Erste Group CEO Andreas Treichl, convinced of the importance of the step that was taken at that time. “The expansion was a very important step for us – and for the Austrian economy as a whole. And this was based on the assumption that the level of prosperity would adjust to the level in Western Europe.” Treichl sees this confirmed by the fact that the regions around Prague and Bratislava are already more prosperous than the EU average.

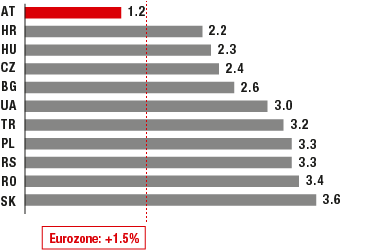

It is a catch-up process that still has to unfold in the other CEE countries and is far from complete. This is shown, for example, by the growth rates of these countries compared to Western Europe. While gross domestic product is expected to increase by 1.5% a year in the Eurozone between 2016 and 2019, the forecast is 3.6% for Slovakia and 3.3% for Poland. There is good reason why the Erste Group bank subsidiaries in the Czech Republic and Slovakia now contribute three-quarters of the Group’s income.

Vienna Insurance Group is also firmly rooted in the CEE region and is a market leader in many countries of the region. “We were already investing in the former Czechoslovakia in 1990 and are now a clear market leader in our Austrian and CEE markets,” explained Elisabeth Stadler, CEO of VIG. The Group now generates half of its profits and more than half of its premiums in the CEE region.

The CEE market is not saturated

Oliver Schumy, CEO of Immofinanz

Eastern European countries have comparatively low levels of national debt. Budget deficits in the region are low.

What makes the CEE market so attractive is the fact that the potential catch-up in terms of penetration of different products is far from complete. “While Austria is considered a thoroughly saturated insurance market where issues such as future provision and health are of great importance, insuring material assets, such as cars, buildings and homes, is still the priority in most CEE countries,” explained Stadler. As a result, insurance expenditure in the CEE region is still only around one twelfth of the level in Austria.

The rise in quality of life and purchasing power has led to increased demand for higher quality products and services. This is also confirmed by Oliver Schumy, CEO of Immofinanz: “We currently earn most of our rental income in the CEE region. The faster the economy grows, the greater the demand for modern office space. And the increased purchasing power bolstered by wage growth and higher employment rates leads to increased retail sales in our shopping centres and retail parks.”

Schumy continues to view the CEE region as an important growth market. Investment volumes improved in 2016 in all of the countries in the region where Immofinanz operates. He believes the greater leeway available for public budgets is also important. “Eastern European countries have comparatively low levels of national debt. Budget deficits in the region are low. The countries have also improved in terms of competitiveness. These are all factors that favour the region,” explained Schumy.

Technology and driver of innovation

Alejandro Plater, CEO and COO of the Telekom Austria Group

Central and Eastern Europe continues to be a highly attractive region, which is why our majority shareholder, América Móvil, invested in the Telekom Austria Group.

It is quite clear to Alejandro Plater, CEO and COO of Telekom Austria Group, that the opportunities in Eastern Europe were one of the reasons the current majority shareholder, América Móvil, invested there. However, in addition to the upward economic trend in these markets, he also mentioned another key argument in favour of the CEE region, namely the innovativeness of the people there. “We particularly see opportunities due to technological change and digitisation. Eastern Europe offers considerable potential in this area. Many of the innovations we use internally come from outside Austria. Belarus was the first market where we completely virtualised our network, and our new TV products were partially developed in Croatia,” said Plater.

In addition to organic growth, the CEE region also naturally offers opportunities for acquisitions. “Our industry will continue to consolidate, particularly with regard to landline networks. Bulgaria alone, for example, has more than 300 regional cable companies, which prevents consumers from receiving benefits from an industry based on economies of scale. Our strategy is to aim for growth in our core business, using new products as well as acquisitions,” explained Plater.

More acquisitions are also an option for VIG, which already operates around 50 companies in the region, and CEO Stadler has announced that she has an appetite for more. “That includes both organic growth from expanding existing businesses and acquisitions. Profitability naturally takes priority in all our considerations. If it is unprofitable, it is taboo for us.” This is aimed at protecting and further expanding VIG’s position as the largest insurance group in Austria and the CEE region.

Confidence and an appetite for more

Andreas Treichl, CEO of Erste Group

When the question of new locations arises, people inevitably take a closer look at the CEE region.

Whether the potential offered by an economic area can actually be exploited depends in part on the basic mood and attitude of the population. Telekom Austria CEO Plater confirms that the people in the CEE region strongly desire change and a better life. “Pessimism, on the other hand, currently dominates the West, even though it is completely unjustified. This naturally has a strong effect on investment and, in turn, on economic development. We need a new spirit of optimism, and the age of digitisation is a good reason for this,” stated Plater.

Erste Bank CEO Treichl also explained that one of the reasons of the rapid growth in the eastern part of the continent was the difference in approach. “In my opinion, this also has to do with the fact that the people in this region want to become more prosperous, believe in themselves, and are therefore ready to take risks. This is something almost impossible to find in Western Europe anymore.”

This desire for more puts the CEE region in an economic pole position for the foreseeable future. Austria borders on this economic area and benefits greatly from the upward trend because many Austrian companies have managed to make the jump from “local players” to established major players in the CEE region. The future of these companies is built on this growth region.

“Growing together” in the best sense of the word is what these corporations are promoting. VIG’s Elisabeth Stadler clarifies the magnitude of the process: “Our premium volume was EUR 1 billion when our eastward expansion began. It is now a little more than EUR 9 billion, and we still have a great deal of upward potential.”

GDP GROWTH

ECONOMIC GROWTH FORECAST

Real GDP growth 2016-19 in % p.a.

The forecast for economic growth in the next few years is significantly higher for Central and Eastern Europe than for Austria and the Eurozone.

Source: IMF, World Economic Outlook database, October 2016