“Clear commitment to growth and efficiency”

VIG is the right choice for investors who believe in CEE. As the market leader in Central and Eastern Europe, VIG is relying on its proven management principles and Agenda 2020 programme to take advantage of the growth potential in the region.

VIG has acquired a unique position in Austria and Central and Eastern Europe. No other insurance company in CEE is positioned so well or is market leader in so many markets (see regionial focus). This means VIG is the right choice for investors who believe in the growth potential of the CEE region – which is fully supported by the macroeconomic indicators. This was already the case 10 or 15 years ago and still applies today. Things have changed, however, since the financial and economic crisis of 2008, and although size is a clear competitive advantage, it is not everything. VIG has always relied on profitable growth, is aware of the changes and has set three important priorities for further successful growth of the Group on its Agenda 2020. We remain committed to our management principles. We continue to promote and make use of the local know-how and entrepreneurial spirit of our around 50 companies to offer optimal insurance solutions and the best possible service to our customers in 25 countries in collaboration with a wide variety of distribution partners. And yet, the key strategic priorities of ensuring future viability and business model optimisation in Agenda 2020 have had a major impact. In addition to systematically expanding promising business areas and profitable lines of business, work is also being done at VIG Holding on improving claims handling measures. The announced mergers of the insurance companies from the former s Versicherung group that were acquired ten years ago are another indicator of our clear commitment to growth, greater efficiency and readiness to change the organisational structure for a promising future. In addition to the life insurance products already being offered through banks, we want to expand the range of attractive products offered to bank customers in the non-life and health insurance areas. The synergy effects expected from the mergers in Austria, the Czech Republic, Slovakia, Hungary and Croatia will also have a positive effect on the Group’s combined ratio over the long term. This will allow us to reach our targets for both premiums and profits.

Commitment to diversity

“We are not only prepared to allow for differences, but we are also able to use diversity positively.”

Nina Higatzberger-Schwarz

The mergers that have been announced or were already completed as well as other possible mergers should not be seen as a rejection of our fundamental multi-brand policy. We still want to maintain as broad a market presence as possible and remain as close to our customers as we can, but with a modern efficient organisation in the background. All digitalisation activities pursued by VIG to allow the technological transformation to take place in the Group’s decentralised organisational structure and drive it forward should be interpreted in this light (see Digital transformation). Diversity has been and continues to be a characteristic of VIG. We are not only prepared to allow for differences, but we are also able to use diversity positively – for the benefit of all our stakeholders.

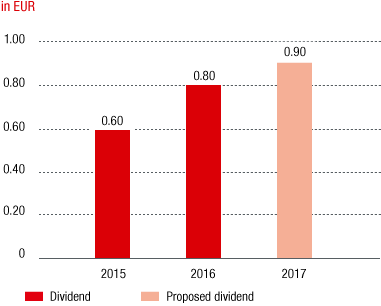

DIVIDEND PER SHARE

This is all taking place from a position of strength, including a strong capital position, as shown by our solvency ratio of 220%, which is within the range of 170 to 230% set by the Managing Board in 2017, and the A+ rating with a stable outlook that S&P has once again confirmed in 2017. We will build on this foundation to achieve further growth, both organic and through acquisitions, in our existing markets.

VIG shows consistency in its dividend payments. VIG has paid out a dividend each year since 1994. Against the backdrop of the Group’s existing dividend policy, VIG distributes at least 30% of Group net profits to its shareholders.

The VIG equity story

- Number 1 in Austria and CEE

VIG is the clear market leader: This puts VIG in an optimal position to benefit from the growth potential in the region. - Diversity as a basic principle

Common strategy and local management: This is how VIG management reduces risk, promotes innovation and makes use of synergies. - Strong capital position

The solvency ratio was 220% calculated at the level of the listed Group. This allows VIG to take advantage of growth opportunities while still maintaining high performance over the long term. - Reliable dividend policy

Dividend payouts each year since 1994: In this way, VIG maintains a balance between earnings and long-term potential.

Questions for Nina Higatzberger-Schwarz

Nina Higatzberger-Schwarz

Head of Investor Relations

Phone: +43 (0) 50 390-21920

Email: nina.higatzberger@vig.com

VIG has a very high equity ratio. Has anything to be done about shareholder returns?

If the solvency ratio of the listed entity were to stay above 230% for a long period of time, we would not exclude considering measures in this area. However, VIG is a growing company and we therefore want to use our strong capital position mainly for growth in the current favourable environment. Moreover, stability is of central importance to us and we therefore take a long-term view. We are, after all, not just responsible toward our shareholders, but first and foremost toward our policyholders. We have to find the proper balance between the interests of all our stakeholder groups in order to achieve good sustainable performance that benefits everyone.

What is VIG’s strategy for acquisitions?

VIG is focusing on acquisitions in markets where our Group companies are not among the top 3 players. This includes, in particular, Poland, Hungary and Croatia. However, due to market consolidation in CEE, VIG is exploring opportunities for bolt-on acquisitions in the entire region. The company being acquired must, however, be a good fit, and the price also has to be right. We are, after all, in a very comfortable position. VIG can make an acquisition, but does not have to.